Starwood 2010 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2010 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.C. Background Information on the Executive Compensation Program

1. Use of Peer Data

In determining competitive compensation levels, the Compensation Committee reviews data from several

major compensation consulting firms that reflects compensation practices for executives in comparable positions in

a peer group consisting of companies in the hotel and hospitality industries and companies with similar revenues in

other industries relevant to key talent recruitment needs. The executive team and Compensation Committee review

the peer group bi-annually to ensure it represents a relevant market perspective. The Compensation Committee

utilizes the peer group for a broad set of comparative purposes, including levels of total compensation, pay mix,

incentive plan and equity usage and other terms of employment. The Company believes that by conducting the

competitive analysis using a broad peer group, which includes companies outside the hospitality industry, it is able

to attract and retain talented executives from outside the hospitality industry. The Company’s experience has proven

that key executives with diversified experience prove to be major contributors to its continued growth and success.

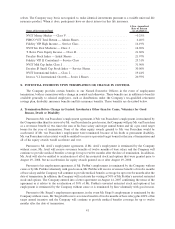

The peer group approved by the Compensation Committee for 2010 is set out below. We expect that it will be

necessary to update the list periodically.

Avon Products MGM Mirage

Carnival Corp. Nike, Inc.

Colgate Palmolive Corporation Simon Property Group Inc.

Estee Lauder Cos. Inc. Staples Inc.

Federal Express Corp. Starbucks Corp.

Host Hotels & Resorts Williams Sonoma Inc.

Kellogg Corporation Walt Disney Co.

Limited Brands Inc. Wyndham Worldwide Corporation

Marriott International, Inc. Yum Brands Inc.

McDonald’s Corp.

In performing its competitive analysis, the Compensation Committee typically reviews:

• base pay;

• target and actual total cash compensation, consisting of salary, target and actual annual incentive awards in

prior years; and

• direct total compensation consisting of salary, target and actual annual incentive awards, and the value of

option and restricted stock/restricted stock unit awards.

When establishing target compensation levels for 2010, the Compensation Committee reviewed peer group

data on payments to named executive officers as reported in proxy statements available as of February 2010 as

provided by Pearl Meyer & Partners.

2. Tax Considerations

Section 162(m) generally disallows a federal income tax deduction to public companies for incentive

compensation in excess of $1,000,000 paid to the chief executive officer and the four other most highly

compensated executive officers. Qualified performance-based compensation is not subject to the deduction limit

if certain requirements are met. The Company believes that compensation paid under the Executive Plan for 2010

meets these requirements and is generally fully deductible for federal income tax purposes.

In designing the Company’s compensation programs, the Compensation Committee carefully considers the

effect of this provision together with other factors relevant to its business needs. In certain circumstances the

Company may approve compensation that does not meet these requirements in order to advance the long-term

interests of its stockholders. In February 2010 the Compensation Committee approved an increase in

Mr. van Paasschen’s base salary from $1,000,000 to $1,250,000. For the 2011 fiscal year, the Compensation

Committee determined that Mr. van Paasschen’s base salary should remain $1,250,000. The Company has

31