Starwood 2010 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2010 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

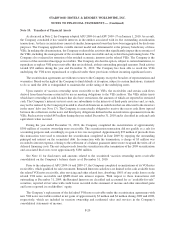

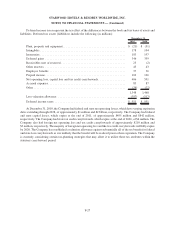

discounted using a rate commensurate with the inherent risk of the project. Under the market approach, fair value

was determined with the comparable sales of similar assets and appraisals.

The Company had remaining restructuring accruals of $29 million as of December 31, 2010, which are

primarily long-term in nature and recorded in other liabilities. The activity in the restructuring and other special

charges account for the year ended December 31, 2010 included payments of $3 million primarily related to the

remaining severance accruals and a restructuring credit of $2 million associated with the reversal of previous

restructuring accruals no longer deemed necessary.

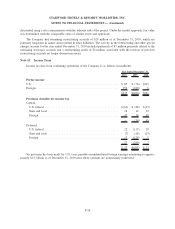

Note 15. Income Taxes

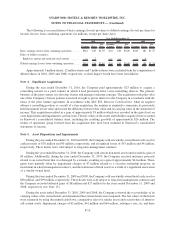

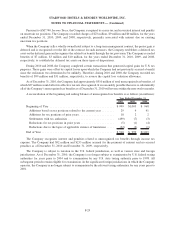

Income tax data from continuing operations of the Company is as follows (in millions):

2010 2009 2008

Year Ended December 31,

Pretax income

U.S. ..................................................... $ 85 $ (76) $315

Foreign ................................................... 250 (220) 6

$335 $(296) $321

Provision (benefit) for income tax

Current:

U.S. federal .............................................. $(61) $ (84) $ (15)

State and local ............................................ 18 12 32

Foreign ................................................. 43 38 48

— (34) 65

Deferred:

U.S. federal .............................................. 22 (117) 28

State and local ............................................ (7) (18) (23)

Foreign ................................................. 12 (124) 2

27 (259) 7

$ 27 $(293) $ 72

No provision has been made for U.S. taxes payable on undistributed foreign earnings amounting to approx-

imately $2.3 billion as of December 31, 2010 since these amounts are permanently reinvested.

F-26

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)