Starwood 2010 Annual Report Download - page 137

Download and view the complete annual report

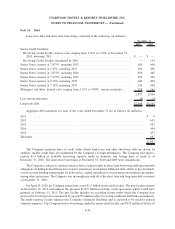

Please find page 137 of the 2010 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In June 2009, the Company securitized approximately $181 million of VOI notes receivable (the “2009-A

Securitization”) resulting in cash proceeds of approximately $125 million. The Company retained $44 million of

interests in the QSPE, which included $43 million of notes the Company effectively owned after the transfer and

$1 million related to the interest only strip. The related loss on the 2009-A Securitization of $2 million is included in

vacation ownership and residential sales and services in the Company’s consolidated statements of income.

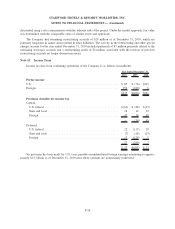

Key assumptions used in measuring the fair value of the Retained Interests at the time of the 2009-A

Securitization were as follows: an average discount rate of 12.8%, an average expected annual prepayment rate

including defaults of 17.9%, and an expected weighted average remaining life of prepayable notes receivable of

52 months. These key assumptions are based on the Company’s historical experience.

In December 2009, the Company securitized approximately $200 million of VOI notes receivable (the

“2009-B Securitization”) resulting in cash proceeds of approximately $166 million. The Company retained

$31 million of interests in the QSPE, which included $22 million of notes the Company effectively owned after

the transfer and $9 million related to the interest only strip. The related gain on the 2009-B Securitization of

$19 million is included in vacation ownership and residential sales and services in the Company’s consolidated

statements of income.

Key assumptions used in measuring the fair value of the Retained Interests at the time of the 2009-B

Securitization were as follows: an average discount rate of 7.5%, an average expected annual prepayment rate

including defaults of 24.4%, and an expected weighted average remaining life of prepayable notes receivable of

69 months. These key assumptions are based on the Company’s historical experience.

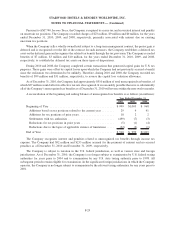

In December 2009, the Company entered into an amendment with the third-party beneficial interest owner

regarding the notes issued in the 2009-A Securitization (the 2009-A Amendment). The amendment to the terms

included a reduction of the coupon rate and an increase in the effective advance rate. As the increase in the advance

rate produced additional cash proceeds of $9 million, this resulted effectively in additional loans sold to the QSPE

from the original over collateralization. The discount rates used in measuring the fair value of the Retained Interests

at the time of the 2009-A Amendment were 6.5% for the interest only strip and 12.8% for the remaining loans

effectively not sold (unchanged from June 2009). The resulting retained interest was $6 million and resulting loans

effectively owned were $33 million. The related gain on the 2009-A Amendment of $4 million is included in

vacation ownership and residential sales and services in the Company’s consolidated statements of income.

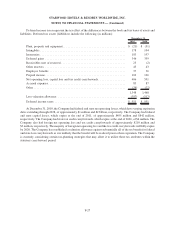

Although the notes effectively owned after the transfers were measured at fair value on the transfer date, they

required prospective accounting treatment as the notes receivable were carried at the basis established at the date of

transfer and accreted interest over time to return to the historical cost basis. During 2009, the Company recorded a

reserve of $4 million related to these loans. As of December 31, 2009, the value of the notes that the Company

effectively owned from the 2009-A Securitization, the 2009-B Securitization and the 2009-A Amendment was

approximately $56 million, which the Company classified as “Other assets” in its consolidated balance sheets.

The Company received aggregate cash proceeds of $21 million and $26 million from the Retained Interests

during 2009 and 2008, respectively. The Company received aggregate servicing fees of $4 million and $3 million

related to these VOI notes receivable during 2009 and 2008, respectively.

At the time of each VOI notes receivable securitization and at the end of each financial reporting period, the

Company estimates the fair value of its Retained Interests using a discounted cash flow model. All assumptions used

in the models are reviewed and updated, if necessary, based on current trends and historical experience. The key

assumptions used in measuring the fair value associated with its note securitizations as of December 31, 2009 was as

follows: an average discount rate of 7.8%, an average expected annual prepayment rate including defaults of 15.8%

and an expected weighted average remaining life of prepayable notes receivable of 86 months.

The fair value of the Company’s Retained Interest as of December 31, 2009 was $25 million with amortized

cost basis of $22 million. Temporary differences in the fair value of the retained interests recorded in other

F-21

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)