Starwood 2010 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2010 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

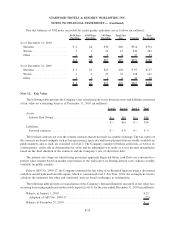

For the vacation ownership and residential segment, the Company records an estimate of expected uncollect-

ibility on its VOI notes receivable as a reduction of revenue at the time it recognizes profit on a timeshare sale. The

Company holds large amounts of homogeneous VOI notes receivable and therefore assesses uncollectibility based

on pools of receivables. In estimating loss reserves, the Company uses a technique referred to as static pool analysis,

which tracks uncollectible notes for each year’s sales over the life of the respective notes and projects an estimated

default rate that is used in the determination of its loan loss reserve requirements. As of December 31, 2010, the

average estimated default rate for the Company’s pools of receivables was 10.0%.

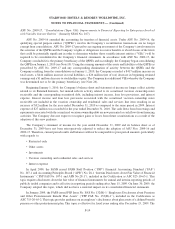

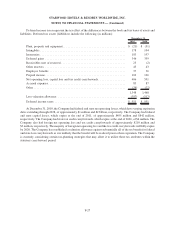

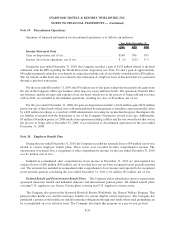

The activity and balances for the Company’s loan loss reserve are as follows (in millions):

Securitized Unsecuritized Total

Balance at December 31, 2007 .......................... $— $68 $ 68

Provisions for loan losses ............................ — 73 73

Write-offs ........................................ — (50) (50)

Other ........................................... — — —

Balance at December 31, 2008 .......................... — 91 91

Provisions for loan losses ............................ — 64 64

Write-Offs ....................................... — (61) (61)

Other ........................................... — — —

Balance at December 31, 2009 .......................... — 94 94

Provisions for loan losses ............................ 14 32 46

Write-Offs ....................................... — (52) (52)

Adoption of ASU No. 2009-17 ........................ 77 (4) 73

Other ........................................... (9) 9 —

Balance at December 31, 2010 .......................... $82 $79 $161

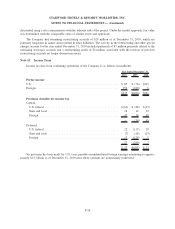

The primary credit quality indicator used by the Company to calculate the loan loss reserve for the vacation

ownership notes is the origination of the notes by brand (Sheraton, Westin, and Other) as the Company believes

there is a relationship between the default behavior of borrowers and the brand associated with the vacation

ownership property they have acquired. In addition to quantitatively calculating the loan loss reserve based on its

static pool analysis, the Company supplements the process by evaluating certain qualitative data, including the

aging of the respective receivables, current default trends by brand and origination year, and the FICO scores of the

buyers.

Given the significance of the Company’s respective pools of VOI notes receivable, a change in the projected

default rate can have a significant impact to its loan loss reserve requirements, with a 0.1% change estimated to have

an impact of approximately $3 million.

The Company considers a VOI note receivable delinquent when it is more than 30 days outstanding. All

delinquent loans are placed on nonaccrual status and the Company does not resume interest accrual until payment is

made. Upon reaching 120 days outstanding, the loan is considered to be in default and the Company commences the

repossession process. Uncollectible VOI notes receivable are charged off when title to the unit is returned to the

Company. The Company generally does not modify vacation ownership notes that become delinquent or upon

default.

F-23

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)