Starwood 2010 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2010 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.historically taken, and intends to continue taking, reasonably practicable steps to minimize the impact of the loss of

deductibility under Section 162(m). Accordingly, the Compensation Committee has determined that each of the

Named Executive Officers will participate under the Executive Plan for 2011.

On October 22, 2004, the American Jobs Creation Act of 2004 was signed into law, adding Section 409A to the

Code and thereby changing the tax rules applicable to nonqualified deferred compensation arrangements effective

January 1, 2005. While final Section 409A regulations were not effective until January 1, 2010, the Company

believes it was operating in good faith compliance with Section 409A and the interpretive guidance thereunder. The

Company entered into amendments to the employment arrangements with its senior officers, including the Chief

Executive Officer and Named Executive Officers, and amended its bonus and compensation plans in December

2008 to meet the requirements of these regulations. A more detailed discussion of the Company’s nonqualified

deferred compensation plan is provided on page 40 under the heading Nonqualified Deferred Compensation.

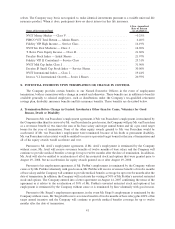

3. Share Ownership Guidelines

The Company has adopted share ownership guidelines for our executive officers, including the Named

Executive Officers. Pursuant to the guidelines, the Named Executive Officers, including the Chief Executive

Officer, are required to hold that number of Shares having a market value equal to or greater than a multiple of each

executive’s base salary. For the Chief Executive Officer, the multiple is five times base salary and for the other

Named Executive Officers, the multiple is four times base salary. A retention requirement of 35% is applied to

restricted Shares upon vesting (net Shares after tax withholding) and Shares obtained from option exercises until the

executive meets the target, or if an executive falls out of compliance. Shares owned, stock equivalents (vested/

unvested restricted stock units), and unvested restricted stock (pre-tax) count towards meeting ownership targets.

However, stock options do not count towards meeting the target. Officers have five years from the date of hire or, if

later, the date they first become subject to the policy, to meet the ownership requirements.

4. Equity Grant Practices

Determination of Option Exercise Prices. The Compensation Committee grants stock options with an

exercise price equal to the fair market value of a Share on the grant date. Under the LTIP, the fair market value of our

common stock on a particular date is determined as the average of the high and low trading prices of a Share on the

NYSE on that date.

Timing of Equity Grants. The Compensation Committee generally makes annual equity compensation

grants to Named Executive Officers following its first regularly scheduled meeting that occurs after the release of

the Company’s earnings for the prior year (typically the grant date is the last business day in February). The timing

of this meeting is determined based on factors unrelated to the pricing of equity grants.

The Compensation Committee approves equity compensation awards to a newly hired executive officer at the

time that the Board meets to approve the executive’s employment package. Generally, the date on which the Board

approves the employment package becomes the grant date of the newly-hired executive officer’s equity compen-

sation awards. However, if the Company and the new executive officer enter into an employment agreement

regarding the employment relationship, the Company requires the executive officer to sign his employment

agreement shortly following the date of Board approval of the employment package; the later of the date on which

the executive officer signs his employment agreement or the date that the executive officer begins employment

becomes the grant date of these equity compensation awards.

The Company’s policy is that the grant date of equity compensation awards is always on or shortly after the

date the Compensation Committee approves the grants, which is generally in February. However, the Compensation

Committee has the discretion under unusual circumstances to award grants at other times in the year.

32