Starwood 2010 Annual Report Download - page 54

Download and view the complete annual report

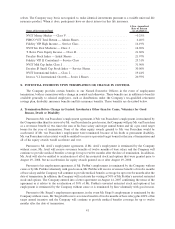

Please find page 54 of the 2010 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Pursuant to Mr. Turner’s employment agreement, if Mr. Turner’s employment is terminated by the Company

other than for cause or by Mr. Turner for good reason, Mr. Turner will receive severance benefits of twelve months

base salary and the Company will continue to provide medical benefits coverage for up to twelve months after the

date of termination.

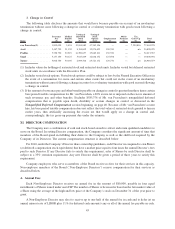

B. Termination in the Event of Change in Control

The Company has entered into severance agreements with each of Messrs. Prabhu and Siegel. Each severance

agreement provides for a term of three years, with automatic one-year extensions until either the executive or the

Company notifies the other that such party does not wish to extend the agreement. If a Change in Control (as

described below) occurs, the agreement will continue for at least 24 months following the date of such Change in

Control.

Each agreement provides that if, following a Change in Control, the executive’s employment is terminated

without Cause (as defined in the agreement) or with Good Reason (as defined in the agreement), the executive

would receive the following in addition to the items described in A. above:

• two times the sum of his base salary plus the average of the annual bonuses earned by the executive in the

three fiscal years ending immediately prior to the fiscal year in which the termination occurs or, if higher, the

annual bonus earned in the immediately prior year;

• continued medical benefits for two years, reduced to the extent benefits of the same type are received by or

made available to the executive from another employer;

• a lump sum amount, in cash, equal to the sum of (A) any unpaid incentive compensation which had been

allocated or awarded to the executive for any measuring period preceding termination under any annual or

long-term incentive plan and which, as of the date of termination, is contingent only upon the continued

employment of the executive until a subsequent date, and (B) the aggregate value of all contingent incentive

compensation awards allocated or awarded to the executive for all then uncompleted periods under any such

plan that the executive would have earned on the last day of the performance award period, assuming the

achievement, at the target level, of the individual and corporate performance goals established with respect

to such award;

• immediate vesting of stock options and restricted stock held by the executive under any stock option or

incentive plan maintained by the Company;

• outplacement services suitable to the executive’s position for a period of two years or, if earlier, until the first

acceptance by the executive of an offer of employment, the cost of which will not exceed 20% of the

executive’s base salary;

• a lump sum payment of the executive’s deferred compensation paid in accordance with Section 409A

distribution rules; and

• immediate vesting of all unvested 401(k) contributions in the executive’s 401(k) account or payment by the

Company of an amount equal to any such unvested amounts that are forfeited by reason of the executive’s

termination of employment.

In addition, to the extent that any executive becomes subject to the “golden parachute” excise tax imposed

under Section 4999 of the Code, the executive would receive a gross-up payment in an amount sufficient to offset

the effects of such excise tax.

Under the severance agreements, a “Change in Control” is deemed to occur upon any of the following events:

• any person becomes the beneficial owner of securities of the Company (not including in the securities

beneficially owned by such person any securities acquired directly from the Company or its affiliates)

representing 25% or more of the combined voting power of the Company;

• a majority of the Directors cease to serve on the Company’s Board in connection with a successful hostile

proxy contest;

42