Starwood 2010 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2010 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

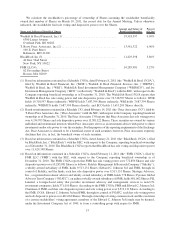

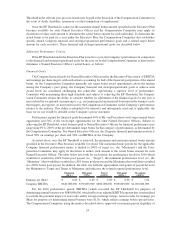

We calculate the stockholder’s percentage of ownership of Shares assuming the stockholder beneficially

owned that number of Shares on March 10, 2011, the record date for the Annual Meeting. Unless otherwise

indicated, the stockholder had sole voting and dispositive power over the Shares.

Name and Address of Beneficial Owner

Amount and Nature of

Beneficial Ownership

Percent

of Class

Waddell & Reed Financial, Inc.(1) ................................. 19,318,597 9.90%

6300 Lamar Avenue

Overland Park, KS 66202

T. Rowe Price Associates, Inc.(2) .................................. 13,581,322 6.96%

100 E. Pratt Street

Baltimore, MD 21202

BlackRock Inc.(3) ............................................. 11,429,398 5.86%

40 East 52nd Street

New York, NY 10022

FMR LLC(4) ................................................. 10,285,981 5.27%

82 Devonshire Street

Boston, MA 02109

(1) Based on information contained in a Schedule 13G/A, dated February 8, 2011 (the “Waddell & Reed 13G/A”),

filed by Waddell & Reed Financial, Inc. (WDR”), Waddell & Reed Financial Services, Inc. (“WRFSI”),

Waddell & Reed, Inc. (“WRI”), Waddell & Reed Investment Management Company (“WRIMCO”), and Ivy

Investment Management Company (“IICO”) (collectively “Waddell & Reed”) with the SEC, with respect to the

Company reporting beneficial ownership as of December 31, 2010. The Waddell & Reed 13G/A reports that

Waddell & Reed has sole voting power and sole dispositive power over 19,318,597 Shares as follows: WDR

holds 19,318,597 Shares indirectly; WRFSI holds 7,687,394 Shares indirectly; WRI holds 7,687,394 Shares

indirectly; WRIMCO holds 7,687,394 Shares directly; and IICO holds 11,631,203 Shares directly.

(2) Based on information contained in a Schedule 13G, dated February 14, 2011 (the “Price Associates 13G”), filed by

T. Rowe Price Associates, Inc. (“Price Associates”) with the SEC, with respect to the Company, reporting beneficial

ownership as of December 31, 2010. The Price Associates 13G reports that Price Associates has sole voting power

over 4,134,703 Shares and sole dispositive power over 13,581,322 Shares. These securities are owned by various

individual and institutional investors which Price Associates serves as an investment adviser with power to direct

investments and/or sole power to vote the securities. For the purposes of the reporting requirements of the Exchange

Act, Price Associates is deemed to be a beneficial owner of such securities; however, Price Associates expressly

disclaims that it is, in fact, the beneficial owner of such securities.

(3) Based on information contained in a Schedule 13G/A, dated January 21, 2011 (the “BlackRock 13G/A”), filed

by BlackRock, Inc. (“BlackRock”) with the SEC, with respect to the Company, reporting beneficial ownership

as of December 31, 2010. The BlackRock 13G/A reports that BlackRock has sole voting and dispositive power

over 11,429,398 Shares.

(4) Based on information contained in a Schedule 13G/A, dated February 11, 2011 (the “FMR 13G/A”), filed by

FMR LLC (“FMR”) with the SEC, with respect to the Company, reporting beneficial ownership as of

December 31, 2010. The FMR 13G/A reports that FMR has sole voting power over 772,850 Shares and sole

dispositive power over 10,285,981 Shares as follows: Fidelity Management & Research Company (“Fidelity”),

a wholly-owned subsidiary of FMR, holds 9,513,131 Shares; Edward C. Johnson 3rd and FMR, through its

control of Fidelity, and the funds, each has sole dispositive power over 9,513,131 Shares; Strategic Advisers,

Inc., a registered investment adviser and wholly owned subsidiary of FMR, holds 778 Shares; Pyramis Global

Advisors Trust Company (“PGATC”), an indirect wholly-owned subsidiary of FMR, holds 401,062 Shares; FIL

Limited, a foreign-based entity that provides investment advisory and management services to non-U.S.

investment companies, holds 371,010 Shares. According to the FMR 13G/A, FMR and Edward C. Johnson 3rd,

Chairman of FMR, each has sole dispositive power and sole voting power over 9,513,131 Shares. According to

the FMR 13G/A, Edward C. Johnson 3rd and FMR, through its control of PGATC, each has sole voting power

and sole dispositive power over 401,062 Shares. Through ownership of voting common stock and the execution

of a certain stockholders’ voting agreement, members of the Edward C. Johnson 3rd family may be deemed,

under the Investment Company Act of 1940, to form a controlling group with respect to FMR.

15