Starwood 2010 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2010 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our Dependence on Hotel and Resort Development Exposes Us to Timing, Budgeting and Other Risks.

We intend to develop hotel and resort properties and residential components of hotel properties, as suitable

opportunities arise, taking into consideration the general economic climate. In addition, the owners and developers

of new-build properties that we have entered into management or franchise agreements with are subject to these

same risks which may impact the amount and timing of fees we had expected to collect from those properties. New

project development has a number of risks, including risks associated with:

• construction delays or cost overruns that may increase project costs;

• receipt of zoning, occupancy and other required governmental permits and authorizations;

• development costs incurred for projects that are not pursued to completion;

• so-called acts of God such as earthquakes, hurricanes, floods or fires that could adversely impact a project;

• defects in design or construction that may result in additional costs to remedy or require all or a portion of a

property to be closed during the period required to rectify the situation;

• ability to raise capital; and

• governmental restrictions on the nature or size of a project or timing of completion.

We cannot assure you that any development project, including sites held for development of vacation

ownership resorts, will in fact be developed, and, if developed, the time period or the budget of such development

may be greater than initially contemplated and the actual number of units or rooms constructed may be less than

initially contemplated.

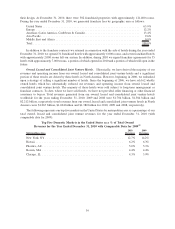

International Operations Are Subject to Unique Political and Monetary Risks. We have significant inter-

national operations which as of December 31, 2010 included 247 owned, managed or franchised properties in Europe,

Africa and the Middle East (including 16 properties with majority ownership); 62 owned, managed or franchised

properties in Latin America (including nine properties with majority ownership); and 181 owned, managed or

franchised properties in the Asia Pacific region (including four properties with majority ownership). International

operations generally are subject to various political, geopolitical, and other risks that are not present in U.S. operations.

These risks include the risk of war, terrorism, civil unrest, expropriation and nationalization as well as the impact in

cases in which there are inconsistencies between U.S. law and the laws of an international jurisdiction. In addition,

some international jurisdictions restrict the repatriation of non-U.S. earnings. Various other international jurisdictions

have laws limiting the ability of non-U.S. entities to pay dividends and remit earnings to affiliated companies unless

specified conditions have been met. In addition, sales in international jurisdictions typically are made in local

currencies, which subject us to risks associated with currency fluctuations. Currency devaluations and unfavorable

changes in international monetary and tax policies could have a material adverse effect on our profitability and

financing plans, as could other changes in the international regulatory climate and international economic conditions.

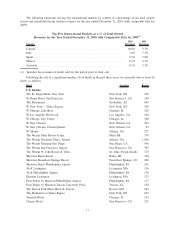

Our Current Growth Strategy is Heavily Dependent on Growth in International Markets. As of December

31, 2010, 84% of our pipeline represented international growth. Further 60% of our pipeline represents new properties

in Asia Pacific with 45% of our pipeline representing new growth in China alone. We must rely on third parties to build

and complete these projects as planned and cannot ensure that all such hotels will be timely constructed. If our third-

party property owners fail to invest in these projects, or fail to invest at estimated levels, the projects may not be

realized or may not be as successful as anticipated. Many countries in the Asia Pacific region, including China, have

construction and operational logistics different than the U.S., including but not limited to labor, transportation, real

estate, and local reporting or legal requirements. Our dependence on international markets for growth is also limited by

the availability of new markets, and we face established competitors that are similarly looking to grow in new markets.

If our international expansion plans are unsuccessful, our financial results could be materially adversely affected.

Third Party Internet Reservation Channels May Negatively Impact Our Bookings. Some of our hotel

rooms are booked through third party internet travel intermediaries such as Travelocity.com», Expedia.com»,

Orbitz.com»and Priceline.com». As the percentage of internet bookings increases, these intermediaries may be

able to obtain higher commissions, reduced room rates or other significant contract concessions from us. Moreover,

some of these internet travel intermediaries are attempting to commoditize hotel rooms by increasing the

8