Starwood 2010 Annual Report Download - page 128

Download and view the complete annual report

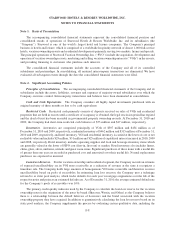

Please find page 128 of the 2010 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Revenue Recognition. The Company’s revenues are primarily derived from the following sources: (1) hotel

and resort revenues at the Company’s owned, leased and consolidated joint venture properties; (2) vacation

ownership and residential revenues; (3) management and franchise revenues; (4) revenues from managed and

franchised properties; and (5) other revenues which are ancillary to the Company’s operations. Generally, revenues

are recognized when the services have been rendered. Taxes collected from customers and submitted to taxing

authorities are not recorded in revenue. The following is a description of the composition of revenues for the

Company:

• Owned, Leased and Consolidated Joint Ventures — Represents revenue primarily derived from hotel

operations, including the rental of rooms and food and beverage sales, from owned, leased or consolidated

joint venture hotels and resorts. Revenue is recognized when rooms are occupied and services have been

rendered.

• Vacation Ownership and Residential — The Company recognizes sales when the buyer has demonstrated a

sufficient level of initial and continuing investment, the period of cancellation with refund has expired and

receivables are deemed collectible. For sales that do not qualify for full revenue recognition as the project

has progressed beyond the preliminary stages but has not yet reached completion, all revenue and profit are

initially deferred and recognized in earnings through the percentage-of-completion method. The Company

has also entered into licensing agreements with third-party developers to offer consumers branded con-

dominiums or residences. The fees from these arrangements are generally based on the gross sales revenue of

the units sold. Residential fee revenue is recorded in the period that a purchase and sales agreement exists,

delivery of services and obligations has occurred, the fee to the owner is deemed fixed and determinable and

collectability of the fees is reasonably assured.

• Management and Franchise Revenues — Represents fees earned on hotels managed worldwide, usually

under long-term contracts, franchise fees received in connection with the franchise of the Company’s

Sheraton, Westin, Four Points by Sheraton, Le Méridien, St. Regis, W, Luxury Collection, Aloft and Element

brand names, termination fees and the amortization of deferred gains related to sold properties for which the

Company has significant continuing involvement. Management fees are comprised of a base fee, which is

generally based on a percentage of gross revenues, and an incentive fee, which is generally based on the

property’s profitability. Base fee revenues are recognized when earned in accordance with the terms of the

contract. For any time during the year, when the provisions of the management contracts allow receipt of

incentive fees upon termination, incentive fees are recognized for the fees due and earned as if the contract

was terminated at that date, exclusive of any termination fees due or payable. Franchise fees are generally

based on a percentage of hotel room revenues and are recognized as the fees are earned and become due from

the franchisee.

• Revenues from Managed and Franchised Properties — These revenues represent reimbursements of costs

incurred on behalf of managed hotel properties and franchisees. These costs relate primarily to payroll costs

at managed properties where the Company is the employer. Since the reimbursements are made based upon

the costs incurred with no added margin, these revenues and corresponding expenses have no effect on the

Company’s operating income or net income.

Insurance Retention. Through its captive insurance company, the Company provides insurance coverage for

workers’ compensation, property and general liability claims arising at hotel properties owned or managed by the

Company through policies written directly and through reinsurance arrangements. Estimated insurance claims

payable represent expected settlement of outstanding claims and a provision for claims that have been incurred but

not reported. These estimates are based on the Company’s assessment of potential liability using an analysis of

available information including pending claims, historical experience and current cost trends. The amount of the

ultimate liability may vary from these estimates. Estimated costs of these self-insurance programs are accrued,

based on the analysis of third-party actuaries.

F-12

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)