Starwood 2010 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2010 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Other revenues from managed and franchised properties decreased primarily due to a decrease in costs,

commensurate with the decline in revenues, at our managed and franchised hotels. These revenues represent

reimbursements of costs incurred on behalf of managed hotel and vacation ownership properties and franchisees

and relate primarily to payroll costs at managed properties where we are the employer. Since the reimbursements

are made based upon the costs incurred with no added margin, these revenues and corresponding expenses have no

effect on our operating income and our net income.

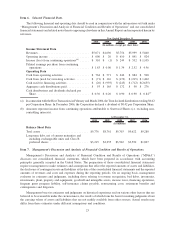

Year Ended

December 31,

2009

Year Ended

December 31,

2008

Increase/

(Decrease)

from Prior

Year

Percentage

Change

from Prior

Year

Selling, General, Administrative and Other . . $314 $377 $(63) (16.7)%

The decrease in selling, general, administrative and other expenses was primarily a result of our focus on

reducing our cost structure in the current economic climate. Beginning in the middle of 2008, we began an activity

value analysis project to review our cost structure across a majority of our corporate departments and divisional

headquarters. (See Note 14 for a summary of charges associated with this initiative.) A majority of the cost

containment initiatives were completed and implemented in late 2008 and early 2009 and are now being realized.

Costs and expenses related to our former Bliss spa business were reclassified to discontinued operations for both

periods presented as a result of its sale at the end of 2009.

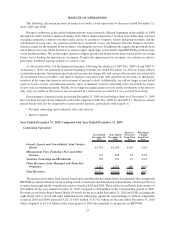

Year Ended

December 31,

2009

Year Ended

December 31,

2008

Increase/

(Decrease)

from Prior

Year

Percentage

Change

from Prior

Year

Restructuring, Goodwill Impairment and

Other Special Charges, Net ......... $379 $141 $238 n/m

During the fourth quarter of 2009, we completed a comprehensive review of our vacation ownership business.

We decided not to develop certain vacation ownership sites and future phases of certain existing projects. As a result

of these decisions, we recorded a primarily non-cash impairment charge of $255 million in the restructuring,

goodwill impairment and other special charges line item. Additionally, we recorded a $90 million non-cash charge

for the impairment of goodwill in the vacation ownership reporting unit.

Additionally, throughout 2009, we recorded restructuring and other special charges of $34 million related to

our ongoing initiative of rationalizing our cost structure. These charges related to severance charges and costs to

close vacation ownership sales galleries.

During the year ended December 31, 2008, we recorded restructuring and other special charges of $141 mil-

lion, including $62 million of severance and related charges associated with our ongoing initiative of rationalizing

our cost structure in light of the current economic climate. We also recorded impairment charges of approximately

$79 million primarily related to the decision not to develop two vacation ownership projects as a result of the

economic climate and its impact on business conditions.

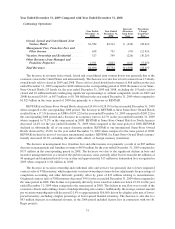

Year Ended

December 31,

2009

Year Ended

December 31,

2008

Increase/

(Decrease)

from Prior

Year

Percentage

Change

from Prior

Year

Depreciation and Amortization ........... $309 $313 $(4) (1.3)%

The decrease in depreciation expense was due to reduced depreciation expense from sold hotels offset by

additional capital expenditures made in the last twelve months.

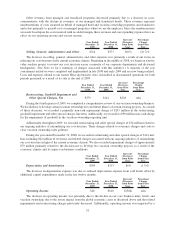

Year Ended

December 31,

2009

Year Ended

December 31,

2008

Increase/

(Decrease)

from Prior

Year

Percentage

Change

from Prior

Year

Operating Income ..................... $26 $610 $(584) n/m

The decrease in operating income was primarily due to the decline in our core business units, hotels and

vacation ownership, due to the severe impact from the global economic crisis as discussed above and the related

impairments and restructuring charges previously discussed. Additionally, operating income was impacted by a

32