Starwood 2010 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2010 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

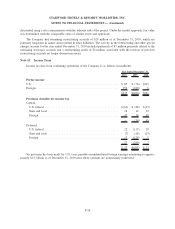

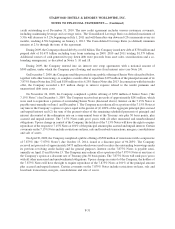

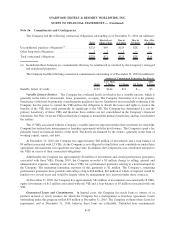

The following table presents the Company’s fair value hierarchy of the plan assets measured at fair value on a

recurring basis as of December 31, 2010 (in millions):

Level 1 Level 2 Level 3 Total

Assets:

Mutual Funds .................................... $44 $ — $— $ 44

Collective Trusts .................................. — 5 — 5

Equity Index Funds ................................ — 72 — 72

Bond Index Funds ................................. — 56 — 56

Total ........................................... $44 $133 $— $177

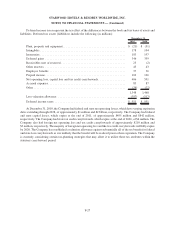

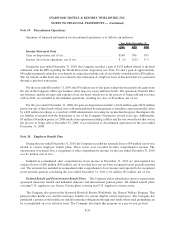

The following table presents the Company’s fair value hierarchy of the plan assets measured at fair value on a

recurring basis as of December 31, 2009 (in millions):

Level 1 Level 2 Level 3 Total

Assets:

Mutual Funds .................................... $40 $ — $— $ 40

Collective Trusts .................................. — 5 — 5

Equity Index Funds ................................ — 67 — 67

Bond Index Funds ................................. — 48 — 48

Total ........................................... $40 $120 $— $160

The mutual funds are valued using quoted market prices in active markets.

The collective trusts, equity index funds and bond index funds are not publicly traded but are valued based on

the underlying assets which are publicly traded.

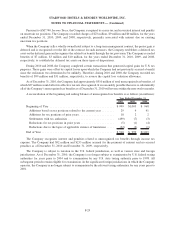

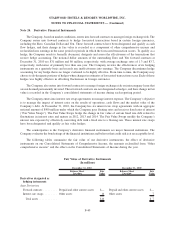

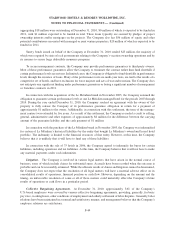

The following table represents the Company’s expected pension and postretirement benefit plan payments for

the next five years and the five years thereafter (in millions):

Domestic

Pension Benefits

Foreign Pension

Benefits

Postretirement

Benefits

2011 ................................... $1 $ 7 $2

2012 ................................... $1 $ 7 $2

2013 ................................... $1 $ 8 $2

2014 ................................... $1 $ 8 $2

2015 ................................... $1 $ 8 $2

2016-2020 ............................... $7 $44 $7

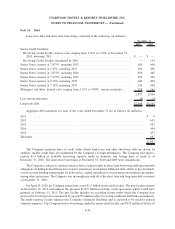

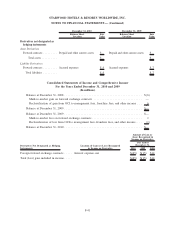

Defined Contribution Plans. The Company and its subsidiaries sponsor various defined contribution plans,

including the Starwood Hotels & Resorts Worldwide, Inc. Savings and Retirement Plan, which is a voluntary

defined contribution plan allowing participation by employees on U.S. payroll who meet certain age and service

requirements. Each participant may contribute on a pretax basis between 1% and 50% of his or her compensation to

the plan subject to certain maximum limits. The plan also contains provisions for matching contributions to be made

by the Company, which are based on a portion of a participant’s eligible compensation. The amount of expense for

matching contributions totaled $13 million in 2010, $15 million in 2009, and $16 million in 2008. Included as an

investment choice is the Company’s publicly traded common stock, which had a balance of $87 million and

$59 million at December 31, 2010 and 2009, respectively.

F-36

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)