Starwood 2010 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2010 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Note 24. Derivative Financial Instruments

The Company, based on market conditions, enters into forward contracts to manage foreign exchange risk. The

Company enters into forward contracts to hedge forecasted transactions based in certain foreign currencies,

including the Euro, Canadian Dollar and Yen. These forward contracts have been designated and qualify as cash

flow hedges, and their change in fair value is recorded as a component of other comprehensive income and

reclassified into earnings in the same period or periods in which the forecasted transaction occurs. To qualify as a

hedge, the Company needs to formally document, designate and assess the effectiveness of the transactions that

receive hedge accounting. The notional dollar amounts of the outstanding Euro and Yen forward contracts at

December 31, 2010 are $31 million and $6 million, respectively, with average exchange rates of 1.3 and 83.7,

respectively, with terms of primarily less than one year. The Company reviews the effectiveness of its hedging

instruments on a quarterly basis and records any ineffectiveness into earnings. The Company discontinues hedge

accounting for any hedge that is no longer evaluated to be highly effective. From time to time, the Company may

choose to de-designate portions of hedges when changes in estimates of forecasted transactions occur. Each of these

hedges was highly effective in offsetting fluctuations in foreign currencies.

The Company also enters into forward contracts to manage foreign exchange risk on intercompany loans that

are not deemed permanently invested. These forward contracts are not designated as hedges, and their change in fair

value is recorded in the Company’s consolidated statements of income during each reporting period.

The Company enters into interest rate swap agreements to manage interest expense. The Company’s objective

is to manage the impact of interest rates on the results of operations, cash flows and the market value of the

Company’s debt. At December 31, 2010, the Company has six interest rate swap agreements with an aggregate

notional amount of $500 million under which the Company pays floating rates and receives fixed rates of interest

(“Fair Value Swaps”). The Fair Value Swaps hedge the change in fair value of certain fixed rate debt related to

fluctuations in interest rates and mature in 2012, 2013 and 2014. The Fair Value Swaps modify the Company’s

interest rate exposure by effectively converting debt with a fixed rate to a floating rate. These interest rate swaps

have been designated and qualify as fair value hedges.

The counterparties to the Company’s derivative financial instruments are major financial institutions. The

Company evaluates the bond ratings of the financial institutions and believes that credit risk is at an acceptable level.

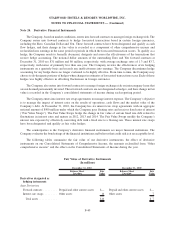

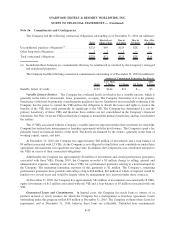

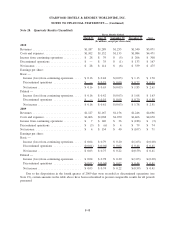

The following tables summarize the fair value of our derivative instruments, the effect of derivative

instruments on our Consolidated Statements of Comprehensive Income, the amounts reclassified from “Other

comprehensive income” and the effect on the Consolidated Statements of Income during the year.

Fair Value of Derivative Instruments

(In millions)

Balance Sheet

Location

Fair

Value

Balance Sheet

Location

Fair

Value

December 31, 2010 December 31, 2009

Derivatives designated as

hedging instruments

Asset Derivatives

Forward contracts . . . . . . . . . Prepaid and other current assets $— Prepaid and other current assets $—

Interest rate swaps. . . . . . . . . Other assets 16 Other assets 7

Total assets . . . . . . . . . . . . $16 $ 7

F-40

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)