Starwood 2010 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2010 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

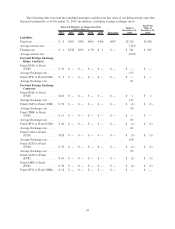

We had the following commercial commitments outstanding as of December 31, 2010 (in millions):

Total

Less Than

1 Year 1-3 Years 3-5 Years

After

5 Years

Standby letters of credit .................. $159 $144 $12 $— $3

A dividend of $0.30 per share was paid in December 2010 to shareholders of record as of December 16, 2010.

A dividend of $0.20 per share was paid in January 2010 to shareholders of record as of December 31, 2009.

Off-Balance Sheet Arrangements

Our off-balance sheet arrangements include letters of credit of $159 million, unconditional purchase obli-

gations of $225 million and surety bonds of $23 million. These items are more fully discussed earlier in this section

and in the Notes to Financial Statements and Item 8 of Part II of this report.

Item 7A. Quantitative and Qualitative Disclosures about Market Risk.

In limited instances, we seek to reduce earnings and cash flow volatility associated with changes in interest

rates and foreign currency exchange rates by entering into financial arrangements intended to provide a hedge

against a portion of the risks associated with such volatility. We continue to have exposure to such risks to the extent

they are not hedged.

We enter into a derivative financial arrangement to the extent it meets the objectives described above, and we

do not engage in such transactions for trading or speculative purposes.

At December 31, 2010, we were party to the following derivative instruments:

• Forward contracts to hedge forecasted transactions for management and franchise fee revenues earned in

foreign currencies. The aggregate dollar equivalent of the notional amounts was approximately $37 million,

and they expire in 2011.

• Forward foreign exchange contracts to manage the foreign currency exposure related to certain intercom-

pany loans not deemed to be permanently invested. The aggregate dollar equivalent of the notional amounts

of the forward contracts was approximately $759 million and they expire in 2011.

38