Starwood 2010 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2010 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

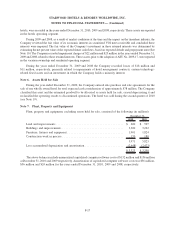

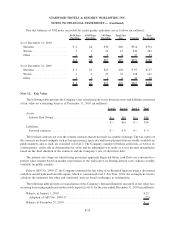

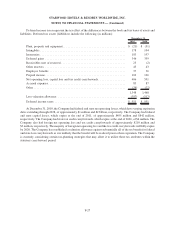

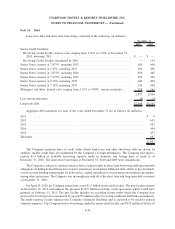

Deferred income taxes represent the tax effect of the differences between the book and tax bases of assets and

liabilities. Deferred tax assets (liabilities) include the following (in millions):

2010 2009

December 31,

Plant, property and equipment....................................... $ (21) $ (51)

Intangibles ..................................................... 178 104

Inventories ..................................................... 183 197

Deferred gains .................................................. 346 359

Receivables (net of reserves) ........................................ 25 (2)

Other reserves .................................................. 43 43

Employee benefits ............................................... 37 36

Prepaid income.................................................. 102 126

Net operating loss, capital loss and tax credit carryforwards ................. 406 591

Accrued expenses ................................................ 83 87

Other . . ....................................................... (34) (22)

1,348 1,468

Less valuation allowance .......................................... (397) (517)

Deferred income taxes ............................................ $ 951 $ 951

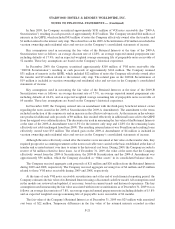

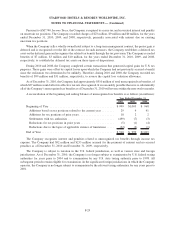

At December 31, 2010, the Company had federal and state net operating losses, which have varying expiration

dates extending through 2028, of approximately $1 million and $2 billion, respectively. The Company had federal

and state capital losses, which expire at the end of 2011, of approximately $495 million and $842 million,

respectively. The Company had state tax credit carryforwards, which expire at the end of 2026, of $4 million. The

Company also had foreign net operating loss and tax credit carryforwards of approximately $210 million and

$3 million, respectively. The majority of foreign net operating loss and the tax credit carryforwards will fully expire

by 2020. The Company has established a valuation allowance against substantially all of the tax benefit for federal

and state loss carryforwards as it is unlikely that the benefit will be realized prior to their expiration. The Company

is currently considering certain tax-planning strategies that may allow it to utilize these tax attributes within the

statutory carryforward period.

F-27

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)