Starwood 2010 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2010 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

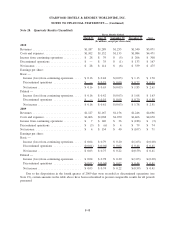

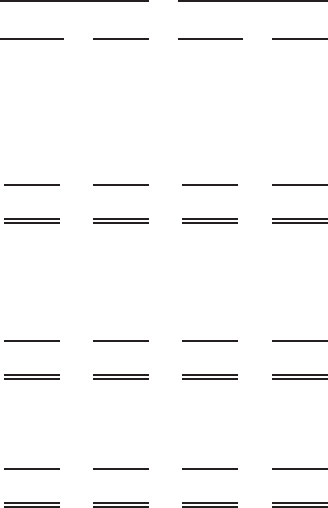

Note 25. Fair Value of Financial Instruments

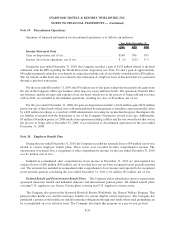

The following table presents the carrying amounts and estimated fair values of the Company’s financial

instruments (in millions):

Carrying

Amount

Fair

Value

Carrying

Amount

Fair

Value

December 31, 2010 December 31, 2009

Assets:

Restricted cash ............................... $ 10 $ 10 $ 7 $ 7

VOI notes receivable ........................... 132 153 222 253

Securitized vacation ownership notes receivable ....... 408 492 — —

Other notes receivable .......................... 19 19 14 14

Total financial assets ......................... $ 569 $ 674 $ 243 $ 274

Liabilities:

Long-term debt ............................... $2,848 $3,120 $2,955 $3,071

Long-term securitized debt ...................... 367 373 — —

Other long-term debt liabilities ................... — — 8 8

Total financial liabilities ...................... $3,215 $3,493 $2,963 $3,079

Off-Balance sheet:

Letters of credit .............................. $ — $ 159 $ — $ 168

Surety bonds . . ............................... — 23 — 21

Total Off-Balance sheet ....................... $ — $ 182 $ — $ 189

The Company believes the carrying values of its financial instruments related to current assets and liabilities

approximate fair value. The Company records its derivative assets and liabilities at fair value. See Note 12 for

recorded amounts and the method and assumption used to estimate fair value.

The carrying value of the Company’s restricted cash approximates its fair value. The Company estimates the

fair value of its VOI notes receivable and securitized VOI notes receivable using assumptions related to current

securitization market transactions. The amount is then compared to a discounted expected future cash flow model

using a discount rate commensurate with the risk of the underlying notes, primarily determined by the credit

worthiness of the borrowers based on their FICO scores. The results of these two methods are then evaluated to

conclude on the estimated fair value. The fair value of other notes receivable is estimated based on terms of the

instrument and current market conditions. These financial instrument assets are recorded in the other assets line

item in the Company’s consolidated balance sheet.

The Company estimates the fair value of its publicly traded debt based on the bid prices in the public debt

markets. The carrying amount of its floating rate debt is a reasonable basis of fair value due to the variable nature of

the interest rates. The Company’s non-public, securitized debt, and fixed rate debt fair value is determined based

upon discounted cash flows for the debt rates deemed reasonable for the type of debt, prevailing market conditions

and the length to maturity for the debt. Other long-term liabilities represent a financial guarantee. The carrying

value of this liability approximates its fair value based on expected funding under the guarantee.

The fair values of the Company’s letters of credit and surety bonds are estimated to be the same as the contract

values based on the nature of the fee arrangements with the issuing financial institutions.

F-42

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)