Starwood 2010 Annual Report Download - page 55

Download and view the complete annual report

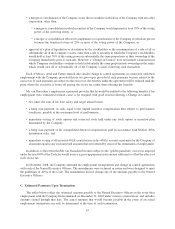

Please find page 55 of the 2010 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• a merger or consolidation of the Company or any direct or indirect subsidiary of the Company with any other

corporation, other than:

Oa merger or consolidation in which securities of the Company would represent at least 70% of the voting

power of the surviving entity; or

Oa merger or consolidation effected to implement a recapitalization of the Company in which no person

becomes the beneficial owner of 25% or more of the voting power of the Company; or

• approval of a plan of liquidation or dissolution by the stockholders or the consummation of a sale of all or

substantially all of the Company’s assets, other than a sale to an entity in which the Company’s stockholders

would hold at least 70% of the voting power in substantially the same proportions as their ownership of the

Company immediately prior to such sale. However, a “Change in Control” does not include a transaction in

which Company stockholders continue to hold substantially the same proportionate ownership in the entity

which would own all or substantially all of the Company’s assets following such transaction.

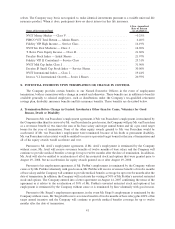

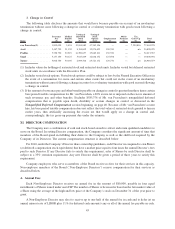

Each of Messrs. Avril and Turner entered into similar change in control agreements in connection with their

employment with the Company, provided that no tax gross-up is provided if such payments become subject to the

excise tax. If such payments are subject to the excise tax, the benefits under the agreement will be reduced until the

point where the executive is better off paying the excise tax rather than reducing the benefits.

Mr. van Paasschen’s employment agreement provides that he would be entitled to the following benefits if his

employment were terminated without cause or he resigned with good reason following a Change in Control:

• two times the sum of his base salary and target annual bonus;

• a lump sum payment, in cash, equal to the unpaid incentive compensation then subject to performance

conditions, payable at the maximum level of performance;

• immediate vesting of stock options and restricted stock held under any stock option or incentive plan

maintained by the Company;

• a lump sum payment of his nonqualified deferred compensation paid in accordance with Section 409A

distribution rules; and

• immediate vesting of all unvested 401(k) contributions in his 401(k) account or payment by the Company of

an amount equal to any such unvested amounts that are forfeited by reason of his termination of employment.

In addition, to the extent that Mr. van Paasschen becomes subject to the “golden parachute” excise tax imposed

under Section 4999 of the Code, he would receive a gross-up payment in an amount sufficient to offset the effects of

such excise tax.

In December 2008, the Company amended the employment arrangements and change in control agreements

with each of the Named Executive Officers. The amendments were technical in nature and were designed to meet

the guidelines of 409A of the Code. The amendments did not change any of the amounts payable to the Named

Executive Officers.

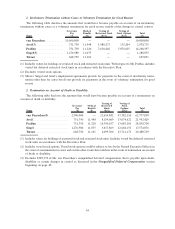

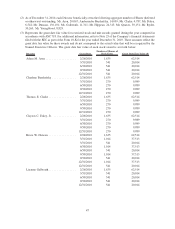

C. Estimated Payments Upon Termination

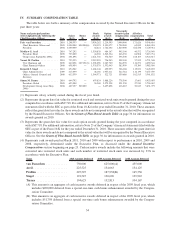

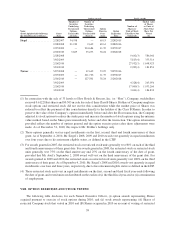

The tables below reflect the estimated amounts payable to the Named Executive Officers in the event their

employment with the Company had terminated on December 31, 2010 under various circumstances, and includes

amounts earned through that date. The actual amounts that would become payable in the event of an actual

employment termination can only be determined at the time of such termination.

43