Starwood 2010 Annual Report Download - page 130

Download and view the complete annual report

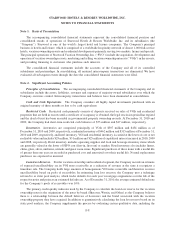

Please find page 130 of the 2010 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ASU No. 2009-17, “Consolidations (Topic 810): Improvements to Financial Reporting by Enterprises Involved

with Variable Interest Entities” (formerly SFAS No. 167).

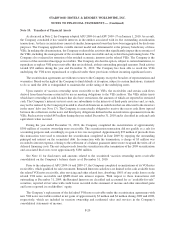

ASU No. 2009-16 amended the accounting for transfers of financial assets. Under ASU No. 2009-16, the

qualifying special purpose entities (“QSPEs”) used in the Company’s securitization transactions are no longer

exempt from consolidation. ASU No. 2009-17 prescribes an ongoing assessment of the Company’s involvement in

the activities of the QSPEs and the Company’s rights or obligations to receive benefits or absorb losses of the trusts

that could be potentially significant in order to determine whether those variable interest entities (“VIEs”) will be

required to be consolidated in the Company’s financial statements. In accordance with ASU No. 2009-17, the

Company concluded it is the primary beneficiary of the QSPEs and accordingly, the Company began consolidating

the QSPEs on January 1, 2010 (see Note 10). Using the carrying amounts of the assets and liabilities of the QSPEs as

prescribed by ASU No. 2009-17 and any corresponding elimination of activity between the QSPEs and the

Company resulting from the consolidation on January 1, 2010, the Company recorded a $417 million increase in

total assets, a $444 million increase in total liabilities, a $26 million (net of tax) decrease in beginning retained

earnings and a $1 million decrease to stockholders equity. The Company has additional VIEs whereby the Company

was determined not to be the primary beneficiary (see Note 26).

Beginning January 1, 2010, the Company’s balance sheet and statement of income no longer reflect activity

related to its Retained Interests, but instead reflects activity related to its securitized vacation ownership notes

receivable and the corresponding securitized debt, including interest income, loan loss provisions, and interest

expense. Interest income and loan loss provisions associated with the securitized vacation ownership notes

receivable are included in the vacation ownership and residential sales and services line item resulting in an

increase of $52 million for the year ended December 31, 2010 as compared to the same period in 2009. Interest

expense of $27 million was recorded for the year ended December 31, 2010. The cash flows from borrowings and

repayments associated with the securitized vacation ownership debt are now presented as cash flows from financing

activities. The Company does not expect to recognize gains or losses from future securitizations as a result of the

adoption of this new guidance.

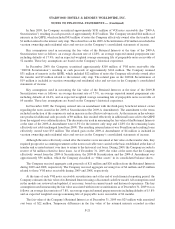

The Company’s statement of income for the year ended December 31, 2009 and its balance sheet as of

December 31, 2009 have not been retrospectively adjusted to reflect the adoption of ASU Nos. 2009-16 and

2009-17. Therefore, current period results and balances will not be comparable to prior period amounts, particularly

with regards to:

• Restricted cash

• Other assets

• Investments

• Vacation ownership and residential sales and services

• Interest expense

In April 2009, the FASB issued FASB Staff Position (“FSP”) Financial Accounting Standard (“FAS”)

No. 107-1 and Accounting Principles Board (“APB”) No. 28-1 “Interim Disclosures about Fair Value of Financial

Instruments” (“FSP FAS No. 107-1 and APB No 28-1”), included in the Codification as ASC 825-10-65-1. This

topic requires disclosures about the fair value of financial instruments for annual and interim reporting periods of

publicly traded companies and is effective in reporting periods ending after June 15, 2009. On June 30, 2009, the

Company adopted this topic, which did not have a material impact on its consolidated financial statements.

In January 2009, the FASB issued FSP Issue No. FAS No. 132(R)-1 “Employers Disclosures about Pensions

and Other Postretirement Benefit Plan Assets” (“FSP FAS No. 132(R)-1”), included in the Codification as

ASC 715-20-65-2. This topic provides guidance on an employer’s disclosures about plan assets of a defined benefit

pension or other postretirement plan. This topic is effective for fiscal years ending after December 15, 2009. The

F-14

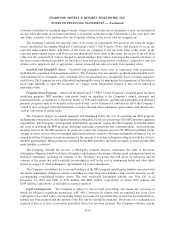

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)