Starwood 2010 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2010 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

hotels, were recorded in the years ended December 31, 2010, 2009 and 2008, respectively. These assets are reported

in the hotels operating segment.

During 2009 and 2008, as a result of market conditions at the time and the impact on the timeshare industry, the

Company reviewed the fair value of its economic interests in securitized VOI notes receivable and concluded these

interests were impaired. The fair value of the Company’s investment in these retained interests was determined by

estimating the net present value of the expected future cash flows, based on expected default and prepayment rates (See

Note 10.) The Company recorded impairment charges of $22 million and $23 million in the years ended December 31,

2009 and 2008, related to these retained interests. These assets, prior to the adoption of ASU No. 2009-17, were reported

in the vacation ownership and residential operating segment.

During the years ended December 31, 2009 and 2008 the Company recorded losses of $18 million and

$11 million, respectively, primarily related to impairments of hotel management contracts, certain technology-

related fixed assets and an investment in which the Company holds a minority interest.

Note 6. Assets Held for Sale

During the year ended December 31, 2009, the Company entered into purchase and sale agreements for the

sale of one wholly owned hotel for total expected cash consideration of approximately $78 million. The Company

classified this asset and the estimated goodwill to be allocated as assets held for sale, ceased depreciating it and

reclassified the operating results to discontinued operations. The hotel was sold during the second quarter of 2010

(see Note 19).

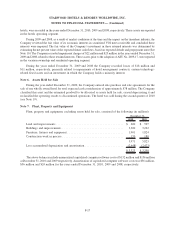

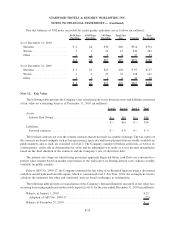

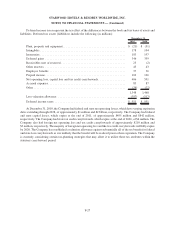

Note 7. Plant, Property and Equipment

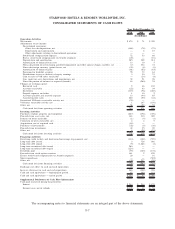

Plant, property and equipment, excluding assets held for sale, consisted of the following (in millions):

2010 2009

December 31,

Land and improvements .......................................... $ 600 $ 597

Buildings and improvements....................................... 3,300 3,222

Furniture, fixtures and equipment ................................... 1,901 1,824

Construction work in process ...................................... 170 180

5,971 5,823

Less accumulated depreciation and amortization ........................ (2,648) (2,473)

$ 3,323 $ 3,350

The above balances include unamortized capitalized computer software costs of $132 million and $136 million

at December 31, 2010 and 2009 respectively. Amortization of capitalized computer software costs was $36 million,

$36 million and $24 million for the years ended December 31, 2010, 2009 and 2008, respectively.

F-17

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)