Starwood 2010 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2010 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

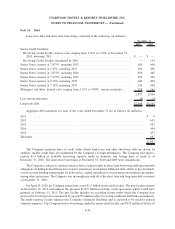

Note 16. Debt

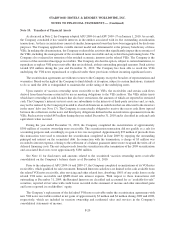

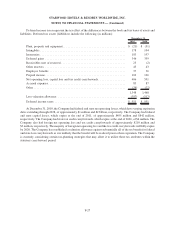

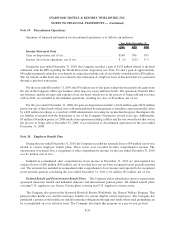

Long-term debt and short-term borrowings consisted of the following (in millions):

2010 2009

December 31,

Senior Credit Facilities:

Revolving Credit Facility interest rates ranging from 1.10% to 2.50% at December 31,

2010, maturing 2013 ................................................. $ — $ —

Revolving Credit Facility, terminated in 2010 ................................. — 114

Senior Notes, interest at 7.875%, maturing 2012 ................................ 609 608

Senior Notes, interest at 6.25%, maturing 2013 ................................. 504 498

Senior Notes, interest at 7.875%, maturing 2014 ................................ 490 485

Senior Notes, interest at 7.375%, maturing 2015 ................................ 450 449

Senior Notes, interest at 6.75%, maturing 2018 ................................. 400 400

Senior Notes, interest at 7.15%, maturing 2019 ................................. 245 244

Mortgages and other, interest rates ranging from 2.15% to 9.00%, various maturities...... 159 162

2,857 2,960

Less current maturities ................................................... (9) (5)

Long-term debt ......................................................... $2,848 $2,955

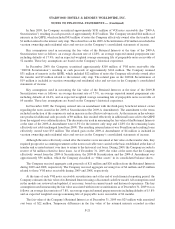

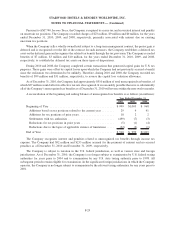

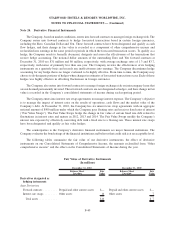

Aggregate debt maturities for each of the years ended December 31 are as follows (in millions):

2011 ........................................................................ $ 9

2012 ........................................................................ 653

2013 ........................................................................ 557

2014 ........................................................................ 494

2015 ........................................................................ 457

Thereafter .................................................................... 687

$2,857

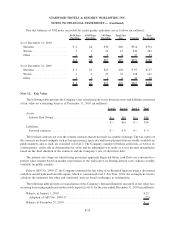

The Company maintains lines of credit under which bank loans and other short-term debt are drawn. In

addition, smaller credit lines are maintained by the Company’s foreign subsidiaries. The Company had approx-

imately $1.4 billion of available borrowing capacity under its domestic and foreign lines of credit as of

December 31, 2010. The short-term borrowings at December 31, 2010 and 2009 were insignificant.

The Company is subject to certain restrictive debt covenants under its short-term borrowing and long-term debt

obligations including defined financial covenants, limitations on incurring additional debt, ability to pay dividends,

escrow account funding requirements for debt service, capital expenditures, tax payments and insurance premiums,

among other restrictions. The Company was in compliance with all of the short-term and long-term debt covenants

at December 31, 2010.

On April 20, 2010, the Company entered into a new $1.5 billion senior credit facility. The new facility matures

on November 15, 2013 and replaces the previous $1.875 billion revolving credit agreement, which would have

matured on February 11, 2011. The new facility includes an accordion feature under which the Company may

increase the revolving loan commitment by up to $375 million subject to certain conditions and bank commitments.

The multi-currency facility enhances the Company’s financial flexibility and is expected to be used for general

corporate purposes. The Company had no borrowings under the senior credit facility and $159 million of letters of

F-30

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)