Starwood 2010 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2010 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Company adopted this topic on December 31, 2009 and incorporated it into its Employee Benefit Plan disclosure

(see Note 20).

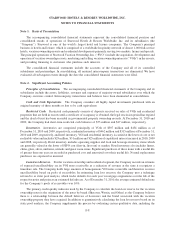

In March 2008, the FASB issued SFAS No. 161, “Disclosures about Derivative Instruments and Hedging

Activities-an amendment of FASB Statement No. 133” (“SFAS No. 161”), included in the Codification as

ASC 815-10-65-1. This topic requires enhanced disclosure related to derivatives and hedging activities. This

topic must be applied prospectively to all derivative instruments and non-derivative instruments that are designated

and qualify as hedging instruments and related hedged items for all financial statements issued for fiscal years and

interim periods beginning after November 15, 2008. The Company adopted this topic on January 1, 2009. See

Note 24 for enhanced disclosures associated with the adoption.

Effective January 1, 2008, the Company adopted SFAS No. 157 related to its financial assets and liabilities and

elected to defer the option of SFAS No. 157 for non-financial assets and non-financial liabilities as allowed by FSP

No. SFAS 157-2 “Effective Date of FASB Statement No. 157,” which was issued in February 2008, included in the

Codification as ASC 820, Fair Value Measurements and Disclosures. This topic defines fair value, establishes a

framework for measuring fair value under generally accepted accounting principles and enhances disclosures about

fair value measurements. Fair value is defined as the exchange price that would be received for an asset or paid to

transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly

transaction between market participants on the measurement date. Valuation techniques used to measure fair value

must maximize the use of observable inputs and minimize the use of unobservable inputs. The standard describes a

fair value hierarchy based on three levels of inputs, of which the first two are considered observable and the last

unobservable, that may be used to measure fair value as follows:

• Level 1 — Quoted prices in active markets for identical assets or liabilities.

• Level 2 — Inputs other than Level 1 that are observable, either directly or indirectly, such as quoted prices

for similar assets or liabilities; quoted prices in markets that are not active; or other inputs that are observable

or can be corroborated by observable market data for substantially the full term of the assets or liabilities.

• Level 3 — Unobservable inputs that are supported by little or no market activity and that are significant to

the fair value of the assets or liabilities.

On January 1, 2009, the Company adopted the provisions of this topic relating to non-financial assets and non-

financial liabilities. The adoption of this statement did not have a material impact on the Company’s consolidated

financial statements.

Future Adoption of Accounting Standards

In October 2009, the FASB issued ASU 2009-13 which supersedes certain guidance in ASC 605-25, Revenue

Recognition — Multiple Element Arrangements. This topic requires an entity to allocate arrangement consideration

at the inception of an arrangement to all of its deliverables based on their relative selling prices. This topic is

effective for annual reporting periods beginning after June 15, 2010. The Company has evaluated this topic and

determined that it will not have a material impact on its consolidated financial statements.

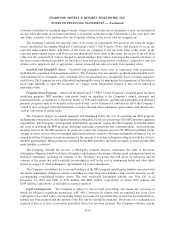

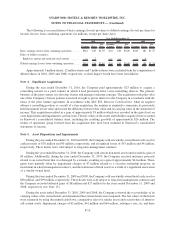

Note 3. Earnings (Losses) per Share

Basic and diluted earnings (losses) per share are calculated using income (losses) from continuing operations

attributable to Starwood’s common shareholders (i.e. excluding amounts attributable to noncontrolling interests).

F-15

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)