Starwood 2010 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2010 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Additionally, we recorded an $8 million credit related to the reversal of a reserve associated with an acquisition in

1998 as the liability is no longer deemed necessary.

During the year ended December 31, 2009, we completed a comprehensive review of our vacation ownership

business. We decided not to develop certain vacation ownership sites and future phases of certain existing projects.

As a result of these decisions, we recorded a primarily non-cash impairment charge of $255 million in the

restructuring, goodwill impairment and other special charges (credits) line item. Additionally, we recorded a

$90 million non-cash charge for the impairment of goodwill in the vacation ownership reporting unit.

Additionally, throughout 2009, we recorded restructuring and other special charges of $34 million related to

our ongoing initiative of rationalizing our cost structure. These charges related to severance charges and costs to

close vacation ownership sales galleries.

Year Ended

December 31,

2010

Year Ended

December 31,

2009

Increase/

(Decrease)

from Prior

Year

Percentage

Change

from Prior

Year

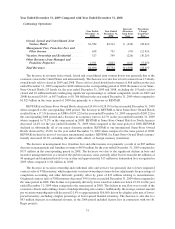

Depreciation and Amortization ........... $285 $309 $(24) 7.8%

The decrease in depreciation expense for the year ended December 31, 2010, when compared to the same

period of 2009, was due to reduced depreciation expense from sold hotels offset by additional capital expenditures

made in the last twelve months.

Year Ended

December 31,

2010

Year Ended

December 31,

2009

Increase/

(Decrease)

from Prior

Year

Percentage

Change

from Prior

Year

Operating Income ..................... $600 $26 $574 n/m

The increase in operating income for the year ended December 31, 2010, when compared to the same period of

2009, is primarily related to the restructuring, goodwill impairments and other special charges (credits) favorable

benefit of $75 million in 2010 compared to a charge of $379 million in 2009 (see earlier discussion). Additionally,

the increase in operating income was favorably impacted by improved operating results in primarily all of our

revenue streams, as discussed earlier.

Year Ended

December 31,

2010

Year Ended

December 31,

2009

Increase/

(Decrease)

from Prior

Year

Percentage

Change

from Prior

Year

Equity Earnings (Losses) and Gains and

Losses from Unconsolidated Ventures,

Net .............................. $10 $(4) $14 n/m

The increase in equity earnings and gains and losses from unconsolidated joint ventures for the year ended

December 31, 2010, when compared to the same period of 2009, was primarily due to improved operating results at

several properties owned by joint ventures in which we hold non-controlling interests. The increase also relates to a

charge of approximately $4 million, in 2009, related to an unfavorable mark-to-market adjustment on a US dollar

denominated loan in an unconsolidated venture in Mexico.

Year Ended

December 31,

2010

Year Ended

December 31,

2009

Increase/

(Decrease)

from Prior

Year

Percentage

Change

from Prior

Year

Net Interest Expense ................... $236 $227 $9 4.0%

The increase in net interest expense was primarily due to interest of $27 million on securitized debt related to

the adoption of ASU No. 2009-17, partially offset by certain early debt extinguishment costs of $21 million that

were incurred in 2009. Our weighted average interest rate was 6.86% at December 31, 2010 as compared to 6.73%

at December 31, 2009.

29