Starwood 2010 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2010 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

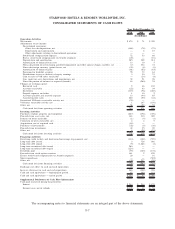

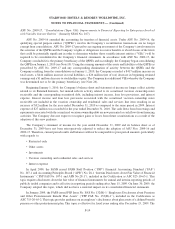

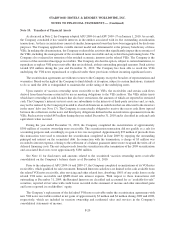

The following is a reconciliation of basic earnings (losses) per share to diluted earnings (losses) per share for

income (losses) from continuing operations (in millions, except per share data):

Earnings Shares

Per

Share

Earnings

(Losses) Shares

Per

Share Earnings Shares

Per

Share

2010 2009 2008

Year Ended December 31,

Basic earnings (losses) from continuing operations ..... $310 183 $1.70 $ (1) 180 $0.00 $249 181 $1.37

Effect of dilutive securities:

Employee options and restricted stock awards ...... — 7 — — — 4

Diluted earnings (losses) from continuing operations .... $310 190 $1.63 $ (1) 180 $0.00 $249 185 $1.34

Approximately 5 million shares, 12 million shares and 7 million shares were excluded from the computation of

diluted shares in 2010, 2009 and 2008, respectively, as their impact would have been anti-dilutive.

Note 4. Significant Acquisitions

During the year ended December 31, 2010, the Company paid approximately $23 million to acquire a

controlling interest in a joint venture in which it had previously held a non-controlling interest. The primary

business of the joint venture is to develop, license and manage restaurant concepts. The acquisition took place after

one of the Company’s former partners exercised its right to put its interest to the Company in accordance with the

terms of the joint venture agreement. In accordance with ASC 805, Business Combinations, when an acquirer

obtains a controlling position as a result of a step acquisition, the acquirer is required to remeasure its previously

held investment to fair value and record the difference between fair value and its carrying value in the statement of

income. This acquisition resulted in a gain of approximately $5 million which was recorded in the gain (loss) on

asset dispositions and impairments, net line item. The fair values of the assets and liabilities acquired were recorded

in Starwood’s consolidated balance sheet, including the resulting goodwill of approximately $26 million. The

results of operations going forward from the acquisition date have been included in Starwood’s consolidated

statements of income.

Note 5. Asset Dispositions and Impairments

During the years ended December 31, 2010 and 2009, the Company sold one wholly-owned hotel each year for

cash proceeds of $70 million and $0 million, respectively, and recognized losses of $53 million and $4 million,

respectively. These hotels were sold subject to long-term management contracts.

During the year ended December 31, 2010, the Company sold certain non-hotel assets and recorded a gain of

$4 million. Additionally, during the year ended December 31, 2010, the Company received insurance proceeds

related to an owned hotel that was damaged by a tornado, resulting in a gain of approximately $14 million. These

gains were partially offset by impairment charges of $7 million related to a vacation ownership property, an

investment in a hotel management contract, and the retirement of fixed assets as a result of a significant renovation

of a wholly-owned hotel.

During the years ended December 31, 2009 and 2008, the Company sold one wholly-owned hotel each year for

$90 million, and $99 million, respectively. These hotels were sold subject to long-term management contracts and

the Company recorded deferred gains of $8 million and $27 million for the years ended December 31, 2009 and

2008, respectively (see Note 13).

During the years ended December 31, 2010, 2009 and 2008, the Company reviewed the recoverability of its

carrying values of its owned hotels and determined that certain hotels were impaired. The fair values of the hotels

were estimated by using discounted cash flows, comparative sales for similar assets and recent letters of intent to

sell certain assets. Impairment charges of $2 million, $41 million and $64 million, relating to one, six, and three

F-16

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)