Starwood 2010 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2010 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

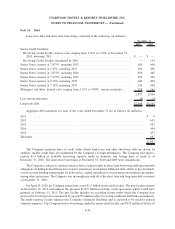

comprehensive income totaled a $3 million gain for the year ended December 31, 2009. Total other-than-temporary

impairments related to credit losses recorded in loss on asset dispositions and impairments totaled $22 million and

$23 million during 2009 and 2008, respectively.

Note 11. Notes Receivable

As discussed in Notes 2 and 10, beginning January 1, 2010, the Company was required to consolidate certain

entities associated with securitization transactions completed in prior years.

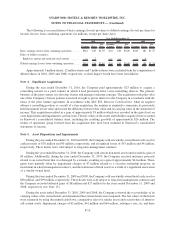

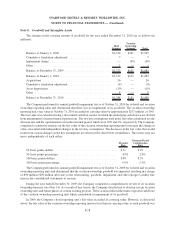

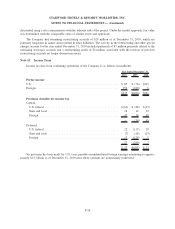

Notes receivable (net of reserves) related to the Company’s vacation ownership loans consist of the following

(in millions):

2010 2009

December 31,

Vacation ownership loans-securitized . ................................... $467 $ —

Vacation ownership loans-unsecuritized .................................. 152 242

619 242

Less: current portion

Vacation ownership loans-securitized .................................. (59) —

Vacation ownership loans-unsecuritized ................................. (20) (20)

$540 $222

The current and long-term maturities of unsecuritized VOI notes receivable are included in accounts receivable

and other assets, respectively, in the Company’s consolidated balance sheets.

The Company records interest income associated with VOI notes in its vacation ownership and residential sale

and services line item in its consolidated statements of income. Interest income related to the Company’s VOI notes

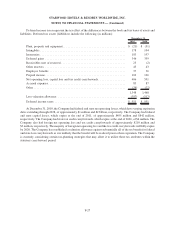

receivable was as follows (in millions):

2010 2009 2008

Year Ended

December 31,

Vacation ownership loans-securitized ................................ $66 $— $—

Vacation ownership loans-unsecuritized .............................. 21 48 57

$87 $48 $57

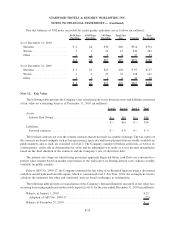

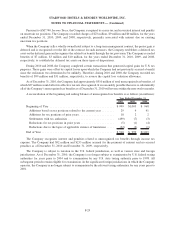

The following tables present future maturities of gross VOI notes receivable and interest rates (in millions):

Securitized Unsecuritized Total

2011 ........................................... $ 69 $ 30 $ 99

2012 ........................................... 72 21 93

2013 ........................................... 75 21 96

2014 ........................................... 75 20 95

Thereafter ....................................... 258 139 397

Balance at December 31, 2010........................ $ 549 $ 231 $ 780

Weighted Average Interest Rates ...................... 12.71% 12.07% 12.49%

Range of interest rates .............................. 6to18% 5to18% 5to18%

F-22

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)