Starwood 2010 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2010 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

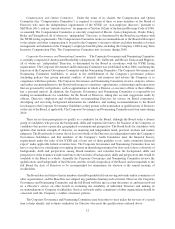

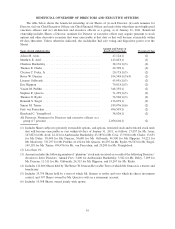

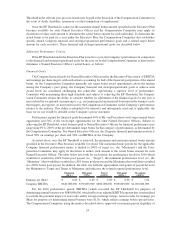

BENEFICIAL OWNERSHIP OF DIRECTORS AND EXECUTIVE OFFICERS

The table below shows the beneficial ownership of our Shares of (i) each Director, (ii) each nominee for

Director, (iii) our Chief Executive Officer, our Chief Financial Officer and each of the other three most highly paid

executive officers and (iv) all directors and executive officers as a group, as of January 31, 2011. Beneficial

ownership includes Shares a Director, nominee for Director or executive officer may acquire pursuant to stock

options and other derivative securities that were exercisable at that date or that will become exercisable within

60 days thereafter. Unless otherwise indicated, the stockholder had sole voting and dispositive power over the

Shares.

Name (Listed alphabetically)

Amount and Nature of

Beneficial Ownership Percent of Class

Adam M. Aron ...................................... 47,124(1) (2)

Matthew E. Avril .................................... 143,823(1) (2)

Charlene Barshefsky .................................. 38,171(1)(3) (2)

Thomas E. Clarke .................................... 22,705(1) (2)

Clayton C. Daley, Jr. ................................. 20,173(1)(3) (2)

Bruce W. Duncan .................................... 194,549(1)(3)(4) (2)

Lizanne Galbreath.................................... 45,991(1)(3) (2)

Eric Hippeau ....................................... 70,813(1)(3) (2)

Vasant M. Prabhu .................................... 348,355(1) (2)

Stephen R. Quazzo ................................... 71,255(1)(5) (2)

Thomas O. Ryder .................................... 76,560(1)(3) (2)

Kenneth S. Siegel .................................... 136,079(1) (2)

Simon M. Turner .................................... 189,076(1)(6) (2)

Frits van Paasschen ................................... 496,507(1) (2)

Kneeland C. Youngblood .............................. 38,029(1) (2)

All Directors, Nominees for Directors and executive officers as a

group (17 persons) ................................. 2,056,616(1) (2)

(1) Includes Shares subject to presently exercisable options, and options, restricted stock and restricted stock units

that will become exercisable or vest within 60 days of January 31, 2011, as follows: 27,057 for Mr. Aron;

143,823 for Mr. Avril; 24,112 for Ambassador Barshefsky; 43,185 for Mr. Cava; 17,918 for Mr. Clarke; 13,631

for Mr. Daley; 58,448 for Mr. Duncan; 34,680 for Ms. Galbreath; 46,500 for Mr. Hippeau; 74,221 for

Mr. McAveety; 331,297 for Mr. Prabhu; 41,104 for Mr. Quazzo; 46,295 for Mr. Ryder; 96,563 for Mr. Siegel;

169,118 for Mr. Turner; 494,476 for Mr. van Paasschen; and 29,200 for Mr. Youngblood.

(2) Less than 1%.

(3) Amount includes the following number of “phantom” stock units received as a result of the following Directors’

election to defer Directors’ Annual Fees: 3,400 for Ambassador Barshefsky; 3,542 for Mr. Daley; 7,499 for

Mr. Duncan; 11,311 for Ms. Galbreath; 24,313 for Mr. Hippeau; and 19,267 for Mr. Ryder.

(4) Includes 121,866 Shares held by The Bruce W. Duncan Revocable Trust of which Mr. Duncan is a trustee and

beneficiary.

(5) Includes 29,754 Shares held by a trust of which Mr. Quazzo is settlor and over which he shares investment

control, and 397 Shares owned by Mr. Quazzo’s wife in a retirement account.

(6) Includes 19,958 Shares owned jointly with spouse.

16