Shaw 2015 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2015 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

Notes to the Consolidated Financial Statements

August 31, 2015 and 2014

[all amounts in millions of canadian dollars except share and per share amounts]

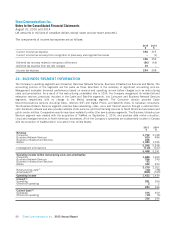

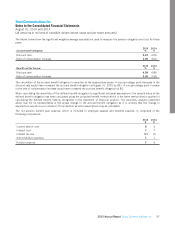

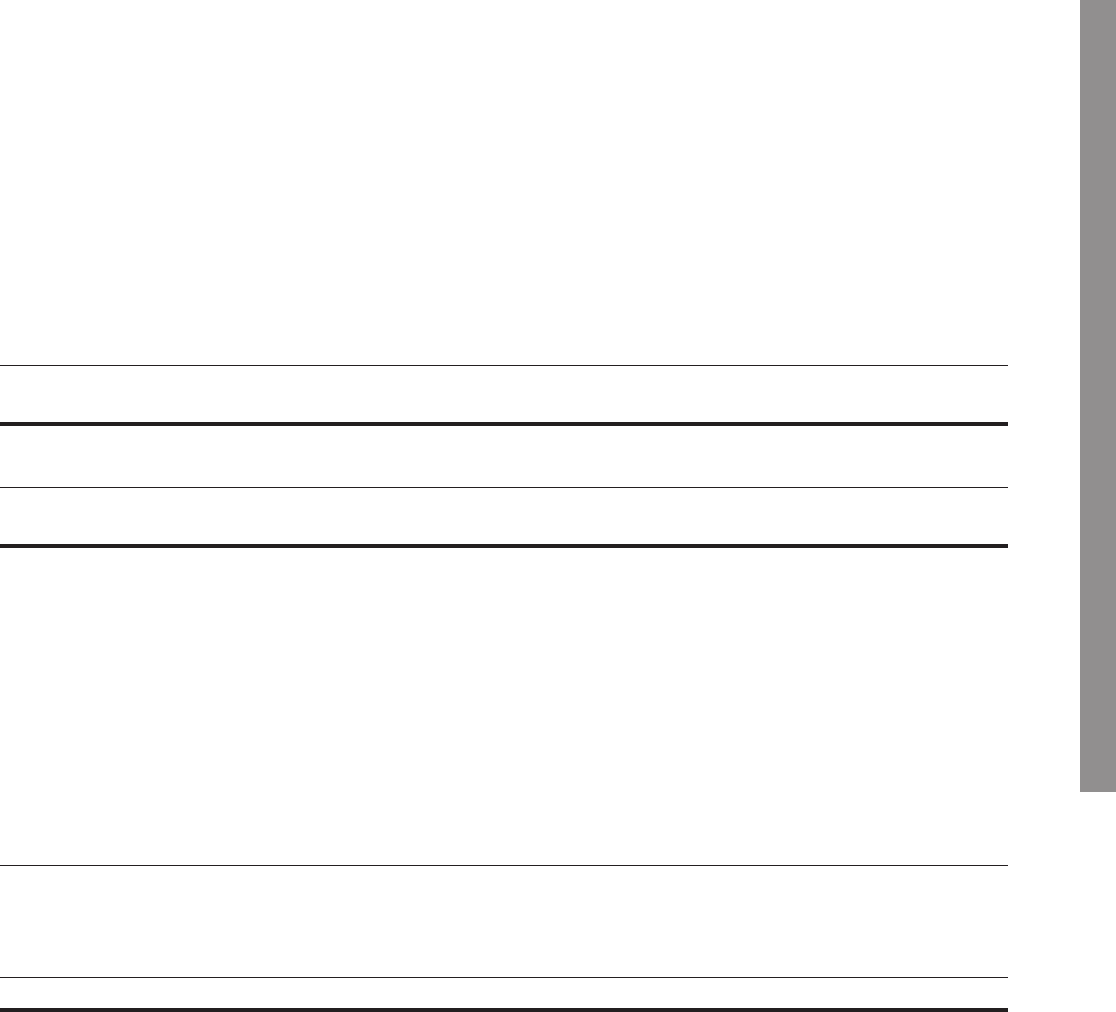

The tables below show the significant weighted-average assumptions used to measure the pension obligation and cost for these

plans.

Accrued benefit obligation

2015

%

2014

%

Discount rate 4.10 4.09

Rate of compensation increase 3.00 3.00

Benefit cost for the year

2015

%

2014

%

Discount rate 4.09 4.84

Rate of compensation increase 3.00 3.50

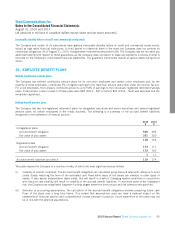

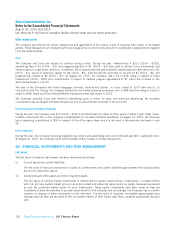

The calculation of the accrued benefit obligation is sensitive to the assumptions above. A one percentage point decrease in the

discount rate would have increased the accrued benefit obligation at August 31, 2015 by $31. A one percentage point increase

in the rate of compensation increase would have increased the accrued benefit obligation by $6.

When calculating the sensitivity of the defined benefit obligation to significant actuarial assumptions, the present value of the

defined benefit obligation has been calculated using the projected benefit method which is the same method that is applied in

calculating the defined benefit liability recognized in the statement of financial position. The sensitivity analysis presented

above may not be representative of the actual change in the accrued benefit obligation as it is unlikely that the change in

assumptions would occur in isolation of one another as some assumptions may be correlated.

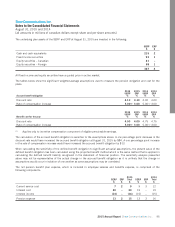

The net pension benefit plan expense, which is included in employee salaries and benefits expense, is comprised of the

following components:

2015

$

2014

$

Current service cost 65

Interest cost 77

Interest income (7) (7)

Administrative expenses 11

Pension expense 76

2015 Annual Report Shaw Communications Inc. 97