Shaw 2015 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2015 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

Management’s Discussion and Analysis

August 31, 2015

Revenue and operating expenses

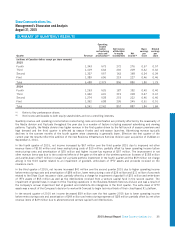

Consolidated revenue of $5.49 billion and operating income before restructuring costs and amortization of $2.38 billion for

fiscal 2015 improved 4.7% and 5.2%, respectively, over 2014. Revenue growth due to the addition of the new Business

Infrastructure Services division and customer growth in the Business Network Services division was partially offset by revenue

declines in the Consumer and Media segments. The decline in Consumer revenue was primarily due to higher promotional

amounts and video and phone subscriber losses including the one-time effect of the CRTC decision mandating

telecommunication providers remove the 30-day cancellation notice requirement, the total of which was partially offset by rate

adjustments effective in 2015 and growth in Internet subscribers. The decrease in Media was driven by specialty channel

advertising revenue declines reflecting general market softness combined with the effect of the disposition of Historia and

Series+ in the prior year. Improvements in operating income before restructuring costs and amortization are primarily attributed

to the acquisition of ViaWest and Consumer division rate increases introduced in fiscal 2015 offset partially by increase in

programming fees and promotional discounts.

Consolidated revenue of $5.24 billion and operating income before restructuring costs and amortization of $2.26 billion for

2014 both improved 1.9% over 2013. Revenue growth was primarily driven by consumer pricing adjustments and growth in

Business which was partially reduced by lower video subscribers, higher programming costs, increased operating costs related to

the new Anik G1 satellite which launched in the third quarter of fiscal 2013 and higher employee related amounts. In addition,

the 2013 fiscal year benefited from a one-time adjustment to align certain broadcast license fees with the CRTC billing period

totaling approximately $14 million.

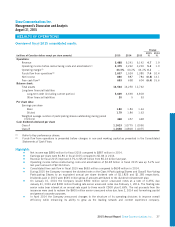

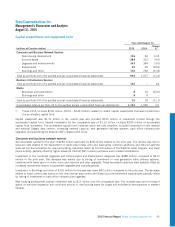

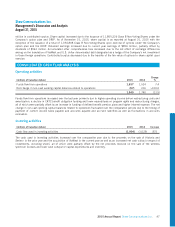

Amortization

(millions of Canadian dollars) 2015 2014

Change

%

Amortization revenue (expense)

Deferred equipment revenue 78 69 13.0

Deferred equipment costs (164) (142) 15.5

Property, plant and equipment, intangibles and other (809) (692) 16.9

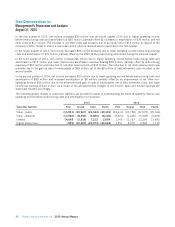

Amortization of deferred equipment revenue and deferred equipment costs increased over the comparable year primarily due to

the impact of the fluctuation in the sales mix of equipment, timing and volume of sales and amortization periods for amounts in

respect of customer premise equipment, as well as changes in customer pricing on certain equipment.

Amortization of property, plant and equipment, intangibles and other increased over the comparable year primarily due to the

impact of the acquisition of ViaWest on September 2, 2014.

Amortization of financing costs and interest expense

(millions of Canadian dollars) 2015 2014

Change

%

Amortization of financing costs – long-term debt 43 33.3

Interest expense 283 266 6.4

Interest expense increased over the comparable year primarily due to the impact of ViaWest’s debt and the drawdown of

US$330 million on the Company’s credit facility to partially finance the acquisition of ViaWest on September 2, 2014 which

was partially offset by the combined impact of a lower average cost of borrowing and an increase in capitalized interest.

2015 Annual Report Shaw Communications Inc. 39