Shaw 2015 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2015 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Shaw Communications Inc.

Notes to the Consolidated Financial Statements

August 31, 2015 and 2014

[all amounts in millions of canadian dollars except share and per share amounts]

Other related parties

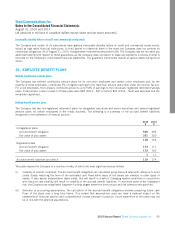

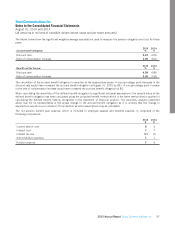

The Company has entered into certain transactions and agreements in the normal course of business with certain of its related

parties. These transactions are measured at the exchange amount, which is the amount of consideration established and agreed

to by the related parties.

Corus

The Company and Corus are subject to common voting control. During the year, network fees of $113 (2014 – $120),

advertising fees of $1 (2014 – $1) and programming fees of $1 (2014 – $1) were paid to various Corus subsidiaries and

entities subject to significant influence. In addition, the Company provided administrative, advertising and other services for $1

(2014 – $1), uplink of television signals for $6 (2014 – $5), Internet services and lease of circuits for $1 (2014 – $1) and

programming content of $2 (2014 – $1). At August 31, 2015, the Company had a net of $18 owing in respect of these

transactions (2014 – $20) and commitments in respect of network program agreements of $7 which are included in the

amounts disclosed in note 25.

The sale of the Company’s two French-language channels, Historia and Series+, to Corus closed in 2014 (see note 3). In

conjunction with the closing, the Company settled the non-interest bearing promissory note of $48 that was owing to Corus in

respect of ABC Spark and Food Canada Network transactions that had closed in 2013.

The Company provided Corus with television advertising spots in return for radio and television advertising. No monetary

consideration was exchanged for these transactions and no amounts were recorded in the accounts.

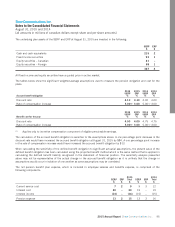

Burrard Landing Lot 2 Holdings Partnership

During the year, the Company paid $12 (2014 – $10) to the Partnership for lease of office space in Shaw Tower. Shaw Tower,

located in Vancouver, BC, is the Company’s headquarters for its lower mainland operations. At August 31, 2015, the Company

had a remaining commitment of $93 in respect of the office space lease which is included in the amounts disclosed in note

25.

Joint arrangement

During the year, the Company providing programming content and advertising services of $18 and paid $6 in subscriber fees.

At August 31, 2015, the Company had a net receivable of $3 in respect of these transactions.

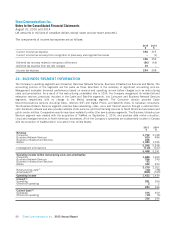

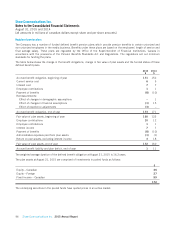

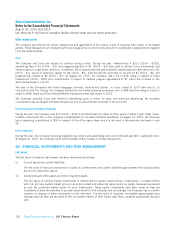

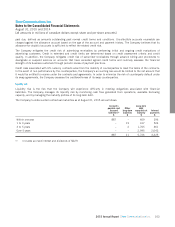

28. FINANCIAL INSTRUMENTS AND RISK MANAGEMENT

Fair values

The fair value of financial instruments has been determined as follows:

(i) Current assets and current liabilities

The fair value of financial instruments included in current assets and current liabilities approximates their carrying value

due to their short-term nature.

(ii) Investments and other assets and Other long-term assets

The fair value of publicly traded investments is determined by quoted market prices. Investments in private entities

which do not have quoted market prices in an active market and whose fair value cannot be readily measured are carried

at cost. No published market exists for such investments. These equity investments have been made as they are

considered to have the potential to provide future benefit to the Company and accordingly, the Company has no current

intention to dispose of these investments in the near term. The fair value of long-term receivables approximates their

carrying value as they are recorded at the net present values of their future cash flows, using an appropriate discount

rate.

100 Shaw Communications Inc. 2015 Annual Report