Shaw 2015 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2015 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

Management’s Discussion and Analysis

August 31, 2015

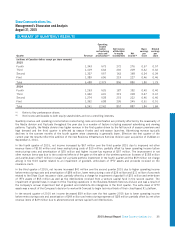

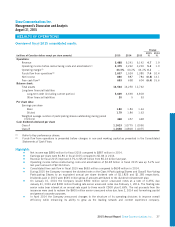

In the first quarter of 2015, net income increased $35 million over the fourth quarter 2014 due to higher operating income

before restructuring costs and amortization of $81 million, partially offset by increases in amortization of $35 million and net

other costs of $17 million. The increase in net other costs was primarily due to an equity loss of $13 million in respect of the

Company’s 50% interest in shomi, a new subscription video-on-demand service launched in the first quarter.

In the fourth quarter of 2014, net income decreased $36 million primarily due to lower operating income before restructuring

costs and amortization of $76 million, partially offset by the effect of the restructuring announced during the previous quarter.

In the third quarter of 2014, net income increased $6 million due to higher operating income before restructuring costs and

amortization of $73 million and lower interest and amortization expense totaling $25 million, partially offset by restructuring

expenses of $53 million and reduction in net other revenue items of $41 million. The reduction in net other revenue items was

primarily due to the gain on sale of media assets of $49 million net of the $8 million of debt retirement costs recorded in the

second quarter.

In the second quarter of 2014, net income decreased $23 million due to lower operating income before restructuring costs and

amortization of $80 million and increased amortization of $8 million, partially offset by an improvement in net other non-

operating items of $36 million due to the aforementioned gain on sale of media assets net of debt retirement costs, and lower

income tax expense of $24 million. As a result of the aforementioned changes in net income, basic and diluted earnings per

share have trended accordingly.

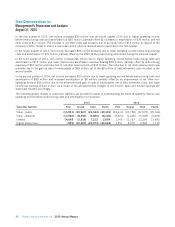

The following growth (losses) in subscriber statistics are provided to assist in understanding the trend of quarterly revenue and

operating income before restructuring costs and amortization for Consumer:

2015 2014

Subscriber Statistics First Second Third Fourth First Second Third Fourth

Video – Cable (15,591) (35,967) (24,524) (39,315) (29,619) (20,758) (12,075) (20,166)

Video – Satellite (17,980) (8,254) (2,820) (8,146) (9,323) (1,405) (5,608) (6,606)

Internet 14,048 (1,819) 7,212 2,699 2,746 12,767 12,399 11,983

Digital phone lines (599) (12,027) (20,974) (29,683) 1,351 8,075 4,834 1,114

36 Shaw Communications Inc. 2015 Annual Report