Shaw 2015 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2015 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

Notes to the Consolidated Financial Statements

August 31, 2015 and 2014

[all amounts in millions of canadian dollars except share and per share amounts]

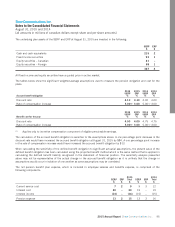

(iii) Long-term debt

The carrying value of long-term debt is at amortized cost based on the initial fair value as determined at the time of

issuance or at the time of a business acquisition. The fair value of publicly traded notes is based upon current trading

values. The fair value of finance lease obligations is determined by discounting future cash flows using a rate for loans

with similar terms, conditions and maturity dates. The carrying value of bank credit facilities approximates fair value as

the debt bears interest at rates that fluctuate with market rates. Other notes and debentures are valued based upon

current trading values for similar instruments.

(vi) Other long-term liabilities

The fair value of program rights payable, estimated by discounting future cash flows, approximates their carrying value.

The fair value of contingent consideration arising from a business acquisition is determined by calculating the present

value of the probability weighted assessment of the likelihood that revenue targets will be met and the estimated timing

of such payments.

(v) Derivative financial instruments

The fair value of US currency forward purchase contracts is determined using an estimated credit-adjusted mark-to-

market valuation using observable forward exchange rates at the end of reporting periods and contract forward rates.

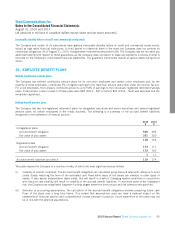

The carrying values and estimated fair values of an investment in a publicly traded company, long-term debt and a

contingent liability are as follows:

August 31, 2015 August 31, 2014

Carrying

value

$

Estimated

fair value

$

Carrying

value

$

Estimated

fair value

$

Assets

Investment in publicly traded company(1) 4477

Liabilities

Long-term debt (including current portion)(2) 5,669 6,307 4,690 5,390

Contingent liability(3) 22––

(1) Level 1 fair value – determined by quoted market prices.

(2) Level 2 fair value – determined by valuation techniques using inputs based on observable market data, either directly or

indirectly, other than quoted prices.

(3) Level 3 fair value – determined by valuation techniques using inputs that are not based on observable market data.

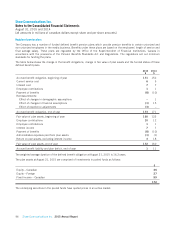

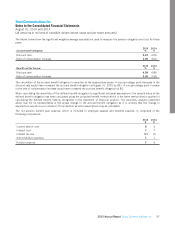

Risk management

The Company is exposed to various market risks including currency risk and interest rate risk, as well as credit risk and liquidity

risk associated with financial assets and liabilities. The Company has designed and implemented various risk management

strategies, discussed further below, to ensure the exposure to these risks is consistent with its risk tolerance and business

objectives.

Market risk

Market risk is the risk that the fair value or cash flows of a financial instrument will fluctuate as a result of changes in market

prices, including foreign exchange and interest rates, the Company’s share price and market price of publicly traded

investments.

2015 Annual Report Shaw Communications Inc. 101