Shaw 2015 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2015 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Shaw Communications Inc.

Notes to the Consolidated Financial Statements

August 31, 2015 and 2014

[all amounts in millions of canadian dollars except share and per share amounts]

The Company has an employee share purchase plan (the “ESPP”) under which eligible employees may contribute to a

maximum of 5% of their monthly base compensation. The Company contributes an amount equal to 25% of the participant’s

contributions and records such amounts as compensation expense.

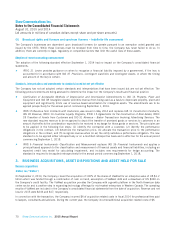

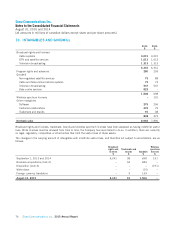

Earnings per share

Basic earnings per share is based on net income attributable to equity shareholders adjusted for dividends on preferred shares

and is calculated using the weighted average number of Class A Shares and Class B Non-Voting Shares outstanding during the

period. Diluted earnings per share is calculated by considering the effect of all potentially dilutive instruments. In calculating

diluted earnings per share, any proceeds from the exercise of stock options and other dilutive instruments are assumed to be

used to purchase Class B Non-Voting Shares at the average market price during the period.

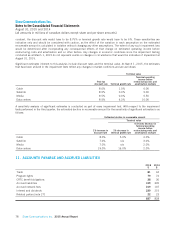

Guarantees

The Company discloses information about certain types of guarantees that it has provided, including certain types of

indemnities, without regard to whether it will have to make any payments under the guarantees.

Estimation uncertainty and critical judgements

The preparation of consolidated financial statements in conformity with IFRS requires management to make estimates and

assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the

date of the consolidated financial statements and the reported amounts of revenues and expenses during the period. Actual

results could differ from those estimates and significant changes in assumptions could cause an impairment in assets. The

following require the most difficult, complex or subjective judgements which result from the need to make estimates about the

effects of matters that are inherently uncertain.

Estimation uncertainty

The following are key assumptions concerning the future and other key sources of estimation uncertainty that could impact the

carrying amount of assets and liabilities and results of operations in future periods.

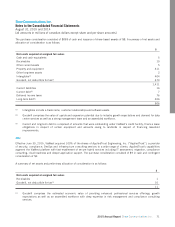

(i) Allowance for doubtful accounts

The Company is required to make an estimate of an appropriate allowance for doubtful accounts on its receivables. The

estimated allowance required is a matter of judgement and the actual loss eventually sustained may be more or less than the

estimate, depending on events which have yet to occur and which cannot be foretold, such as future business, personal and

economic conditions.

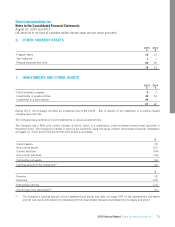

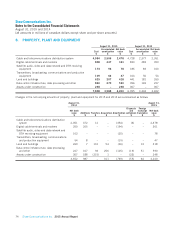

(ii) Property, plant and equipment

The Company is required to estimate the expected useful lives of its property, plant and equipment. These estimates of useful

lives involve significant judgement. In determining these estimates, the Company takes into account industry trends and

company-specific factors, including changing technologies and expectations for the in-service period of these assets.

Management’s judgement is also required in determination of the amortization method, the residual value of assets and the

capitalization of labour and overhead.

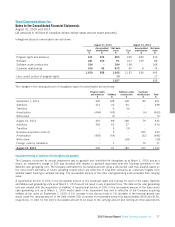

(iii) Business combinations – purchase price allocation

Purchase price allocations involve uncertainty because management is required to make assumptions and judgements to

estimate the fair value of the identifiable assets acquired and liabilities assumed in business combinations. Fair value estimates

are based on quoted market prices and widely accepted valuation techniques, including discounted cash flow (“DCF”) analysis.

Such estimates include assumptions about inputs to the valuation techniques, industry economic factors and business

strategies.

68 Shaw Communications Inc. 2015 Annual Report