Shaw 2015 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2015 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Shaw Communications Inc.

Notes to the Consolidated Financial Statements

August 31, 2015 and 2014

[all amounts in millions of canadian dollars except share and per share amounts]

(ii) Broadcast rights and licenses and spectrum licenses – indefinite-life assessment

The Company’s businesses are dependent upon broadcast licenses (or operate pursuant to an exemption order) granted and

issued by the CRTC. While these licenses must be renewed from time to time, the Company has never failed to do so. In

addition, there are currently no legal, regulatory or competitive factors that limit the useful lives of these assets.

Adoption of recent accounting pronouncement

The adoption of the following standard effective September 1, 2014 had no impact on the Company’s consolidated financial

statements.

ŠIFRIC 21 Levies provides guidance on when to recognize a financial liability imposed by a government, if the levy is

accounted for in accordance with IAS 37 Provisions, Contingent Liabilities and Contingent Assets, or where the timing

and amount of the levy is certain.

Standards, interpretations and amendments to standards issued but not yet effective

The Company has not yet adopted certain standards and interpretations that have been issued but are not yet effective. The

following pronouncements are being assessed to determine the impact on the Company’s results and financial position.

ŠClarification of Acceptable Methods of Depreciation and Amortization (Amendments to IAS 16 Property, Plant and

Equipment and IAS 38 Intangible Assets) prohibits revenue from being used as a basis to depreciate property, plant and

equipment and significantly limits use of revenue-based amortization for intangible assets. The amendments are to be

applied prospectively for the annual period commencing September 1, 2016.

ŠIFRS 15 Revenue from Contracts with Customers, was issued in May 2014 and replaces IAS 11 Construction Contracts,

IAS 18 Revenue, IFRIC 13 Customer Loyalty Programs, IFRIC 15 Agreements for the Construction of Real Estate, IFRIC

18 Transfers of Assets from Customers and SIC-31 Revenue – Barter Transactions Involving Advertising Services. The

new standard requires revenue to be recognized to depict the transfer of promised goods or services to customers in an

amount that reflects the consideration expected to be received in exchange for those goods or services. The principles are

to be applied in the following five steps: (1) identify the contract(s) with a customer, (2) identify the performance

obligations in the contract, (3) determine the transaction price, (4) allocate the transaction price to the performance

obligations in the contract, and (5) recognize revenue when (or as) the entity satisfies a performance obligation. The new

standard is to be applied either retrospectively or on a modified retrospective basis and is effective for the annual period

commencing September 1, 2018.

ŠIFRS 9 Financial Instruments: Classification and Measurement replaces IAS 39 Financial Instruments and applies a

principal-based approach to the classification and measurement of financial assets and financial liabilities, including an

expected credit loss model for calculating impairment, and includes new requirements for hedge accounting. The

standard is required to be applied retrospectively for the annual period commencing September 1, 2018.

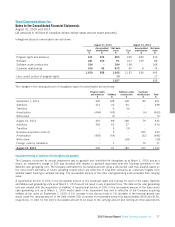

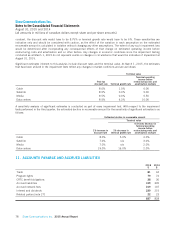

3. BUSINESS ACQUISITIONS, ASSET DISPOSITIONS AND ASSET HELD FOR SALE

Business acquisitions

ViaWest, Inc (“ViaWest”)

On September 2, 2014, the Company closed the acquisition of 100% of the shares of ViaWest for an enterprise value of US $1.2

billion which was funded through a combination of cash on hand, assumption of ViaWest debt and a drawdown of US $330 on

the Company’s credit facility. The ViaWest acquisition provides the Company with a growth platform in the North American data

centre sector and is another step in expanding technology offerings for mid-market enterprises in Western Canada. The operating

results of ViaWest are included in the Company’s consolidated financial statements from the date of acquisition. Revenue and net

loss for 2015 were $246 and $17, respectively.

In connection with the transaction, the Company incurred $4 of acquisition related costs in fiscal 2014 for professional fees paid

to lawyers, consultants and advisors. During the current year, the Company incurred additional acquisition related costs of $6.

70 Shaw Communications Inc. 2015 Annual Report