Shaw 2015 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2015 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

Management’s Discussion and Analysis

August 31, 2015

to be applied in the following five steps: (1) identify the contract(s) with a customer, (2) identify the performance

obligations in the contract, (3) determine the transaction price, (4) allocate the transaction price to the performance

obligations in the contract, and (5) recognize revenue when (or as) the entity satisfies a performance obligation. The new

standard is to be applied either retrospectively or on a modified retrospective basis and is effective for the annual period

commencing September 1, 2018.

ŠIFRS 9 Financial Instruments: Classification and Measurement, replaces IAS 39 Financial Instruments and applies a

principal-based approach to the classification and measurement of financial assets and financial liabilities, including an

expected credit loss model for calculating impairment, and includes new requirements for hedge accounting. The

standard is required to be applied retrospectively for the annual period commencing September 1, 2018.

KNOWN EVENTS, TRENDS, RISKS AND UNCERTAINTIES

The discussion in this MD&A addresses only what management has determined to be the most significant known events, trends,

risks and uncertainties relevant to the Company, its operations and/or its financial results. This discussion is not exhaustive.

The discussion of these matters should be considered in conjunction with the “Caution Concerning Forward-Looking

Statements”.

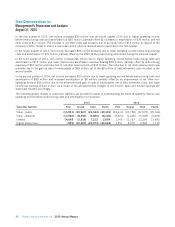

Competition and technological change

Shaw operates in an open and competitive marketplace. Our businesses face competition from regulated and unregulated

entities using existing or new communications technologies and from illegal services. In addition, the rapid deployment of new

technologies, services and products has reduced the traditional lines between telecommunications, Internet and broadcasting

services and further expands the competitive landscape. Shaw may face competition in the future from other technologies being

developed or yet to be developed. While Shaw continually seeks to strengthen its competitive position through investments in

infrastructure, technology, programming and customer service, and through acquisitions, there can be no assurance that these

investments will be sufficient to maintain Shaw’s market share or performance in the future.

The following competitive events, trends, risks and/or uncertainties specific to areas of our business may have a material

adverse effect on Shaw, its operations and/or its financial results. In each case, the competitive events, trends, risks and/or

uncertainties may increase or continue to increase.

Consumer video

Shaw’s Consumer video services, delivered through both our network-connected and satellite platforms, compete with other

distributors of video and audio signals, including telephone companies offering video services, other satellite-based video

services, other competitive cable television undertakings and OTA local and regional broadcast television signals. We also

compete increasingly with unregulated over-the-top video services and offerings available over Internet connections. Continued

improvements in the quality of streaming video over the Internet and the increasing availability of television shows and movies

online has increased and will continue to increase competition to Shaw’s Consumer video services. Our satellite services also

compete with illegal satellite services including grey and black market offerings.

We expect that competition, including aggressive discounting practices by competitors to gain market share, will continue to

increase.

Consumer Internet

High-speed Internet access services are principally provided through cable modem and digital subscriber line technology, and

increasingly through fibre to the home. Shaw competes with a number of different types of ISPs offering residential Internet

access including independent service providers, traditional telephone companies, wireless providers and resellers making use of

TPIA to provide Internet access in various markets.

Shaw expects that consumer demand for higher Internet access speeds and greater bandwidth will continue to be driven by

bandwidth-intensive applications including streaming video, digital downloading and interactive gaming. As described further

under “Shaw’s Network”, Shaw continues to expand the capacity and efficiency of its network to handle the anticipated

increases in consumer demand for higher Internet access speeds and greater bandwidth, however there can be no assurance

that our investments in network capacity will continue to meet this increasing demand.

30 Shaw Communications Inc. 2015 Annual Report