Shaw 2015 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2015 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

Management’s Discussion and Analysis

August 31, 2015

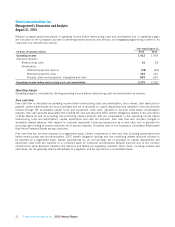

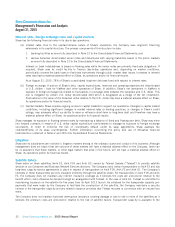

The Company uses free cash flow as a measure of the Company’s ability to repay debt and return cash to shareholders.

Consolidated free cash flow is calculated as follows:

Year ended August 31,

(millions of Canadian dollars) 2015 2014(3)

Revenue

Consumer 3,752 3,768

Business Network Services 520 484

Business Infrastructure Services 246 –

Media 1,080 1,096

5,598 5,348

Intersegment eliminations (110) (107)

5,488 5,241

Operating income before restructuring costs and amortization(1)

Consumer 1,686 1,669

Business Network Services 256 240

Business Infrastructure Services 95 –

Media 342 353

2,379 2,262

Capital expenditures and equipment costs (net):(2)

Consumer and Business Network Services 954 1,077

Business Infrastructure Services 152 –

Media 16 18

1,122 1,095

Accelerated Capital Fund Investment(1) (150) (240)

Total 972 855

Free cash flow before the following 1,407 1,407

Less

Interest (281) (264)

Cash taxes (375) (359)

Other adjustments:

Non-cash share-based compensation 43

CRTC benefit obligation funding (31) (58)

Non-controlling interests (26) (31)

Pension adjustment (45) (5)

Customer equipment financing 13 18

Preferred share dividends (13) (13)

Free cash flow 653 698

Operating margin(1)

Consumer 44.9% 44.3%

Business Network Services 49.2% 49.6%

Business Infrastructure Services 38.6% n/a

Media 31.7% 32.2%

(1) Refer to Key performance drivers.

(2) Per Note 24 to the audited Consolidated Financial Statements.

(3) Restated to reflect the change in segment reporting whereby residential and enterprise services that were

included in the Cable and Satellite segments are now realigned into new Consumer and Business Network

Services segments.

2015 Annual Report Shaw Communications Inc. 23