Shaw 2015 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2015 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

Notes to the Consolidated Financial Statements

August 31, 2015 and 2014

[all amounts in millions of canadian dollars except share and per share amounts]

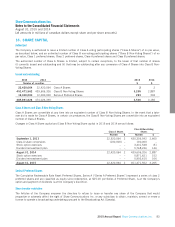

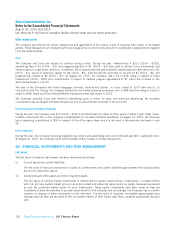

Irrevocable standby letters of credit and commercial surety bonds

The Company and certain of its subsidiaries have granted irrevocable standby letters of credit and commercial surety bonds,

issued by high rated financial institutions, to third parties to indemnify them in the event the Company does not perform its

contractual obligations. As of August 31, 2015, the guarantee instruments amounted to $4. The Company has not recorded any

additional liability with respect to these guarantees, as the Company does not expect to make any payments in excess of what is

recorded on the Company’s consolidated financial statements. The guarantee instruments mature at various dates during fiscal

2016.

26. EMPLOYEE BENEFIT PLANS

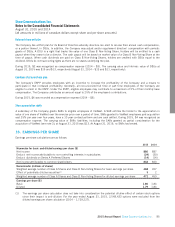

Defined contribution pension plans

The Company has defined contribution pension plans for its non-union employees and certain union employees and, for the

majority of these employees, contributes 5% of eligible earnings to the maximum amount deductible under the Income Tax Act.

For union employees, the Company contributes amounts up to 9.8% of earnings to the individuals’ registered retirement savings

plans. Total pension costs in respect of these plans were $38 (2014 – $37) of which $26 (2014 – $24) was expensed and the

remainder capitalized.

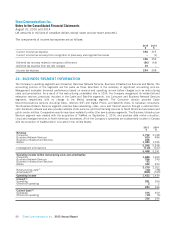

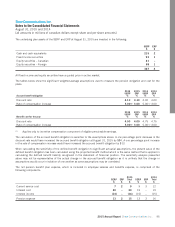

Defined benefit pension plans

The Company has two non-registered retirement plans for designated executives and senior executives and several registered

pension plans for certain employees in the media business. The following is a summary of the accrued benefit liabilities

recognized in the statement of financial position.

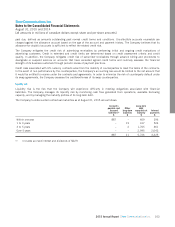

2015

$

2014

$

Unregistered plans

Accrued benefit obligation 509 493

Fair value of plan assets 391 330

118 163

Registered plans

Accrued benefit obligation 173 171

Fair value of plan assets 172 160

111

Accrued benefit liabilities and deficit 119 174

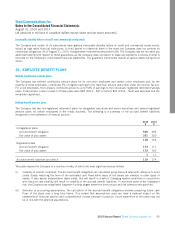

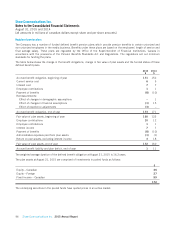

The plans expose the Company to a number of risks, of which the most significant are as follows:

(i) Volatility in market conditions: The accrued benefit obligations are calculated using discount rates with reference to bond

yields closely matching the term of the estimated cash flows while many of the assets are invested in other types of

assets. If plan assets underperform these yields, this will result in a deficit. Changing market conditions in conjunction

with discount rate volatility will result in volatility of the accrued benefit liabilities. To minimize some of the investment

risk, the Company has established long-term funding targets where the time horizon and risk tolerance are specified.

(ii) Selection of accounting assumptions: The calculation of the accrued benefit obligations involves projecting future cash

flows of the plans over a long time frame. This means that assumptions used can have a material impact on the

statements of financial position and comprehensive income because in practice, future experience of the plans may not

be in line with the selected assumptions.

2015 Annual Report Shaw Communications Inc. 93