Shaw 2015 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2015 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

Notes to the Consolidated Financial Statements

August 31, 2015 and 2014

[all amounts in millions of canadian dollars except share and per share amounts]

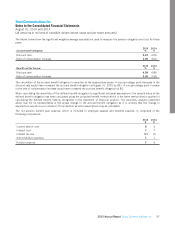

Non-registered pension plans

The Company provides a supplemental executive retirement plan (“SERP”) for certain of its senior executives. Benefits under

this plan are based on the employees’ length of service and their highest three-year average rate of eligible pensionable earnings

during their years of service. In 2012, the Company closed the plan to new participants and amended the plan to freeze base

salary levels at August 31, 2012 for purposes of determining eligible pensionable earnings. The plan was also amended to

provide funding of up to 90% of the accrued benefit obligation over a period of six years. Employees are not required to

contribute to this plan. Subsequent to year end, the Company made contributions of $25 to a Retirement Compensation

Arrangement Trust (“RCA”).

The Company provides an executive retirement plan (“ERP”) for certain executives not covered by the SERP. Benefits under

this plan are comprised of defined contribution and defined benefit components and are based on the employees’ length of

service as well as final average earnings during their years of service. Employees are not required to contribute to this

plan. Annually the employer is to fund 90% of the accrued benefit obligation. Subsequent to year end, the Company made

contributions of $2 to an RCA.

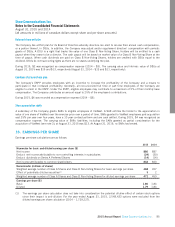

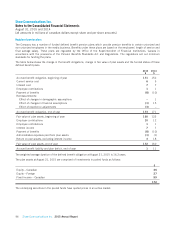

The table below shows the change in benefit obligation and funding status and the fair value of plan assets.

SERP

$

ERP

$

2015

Total

$

SERP

$

ERP

$

2014

Total

$

Accrued benefit obligation, beginning of year 487 6 493 404 2 406

Current service cost 72 9 93 12

Interest cost 20 – 20 19 – 19

Payment of benefits (13) – (13) (10) – (10)

Gain on settlement – (1) (1) –– –

Remeasurements:

Effect of changes in demographic assumptions (11) – (11) 1– 1

Effect of changes in financial assumptions 1– 151 1 52

Effect of experience adjustments 11 – 11 13 – 13

Accrued benefit obligation, end of year 502 7 509 487 6 493

Fair value of plan assets, beginning of year 328 2 330 302 – 302

Employer contributions 55 2 57 13 2 15

Interest income 14 – 14 15 – 15

Payment of benefits (13) – (13) (10) – (10)

Return on plan assets, excluding interest income 3– 3 8– 8

Fair value of plan assets, end of year 387 4 391 328 2 330

Accrued benefit liability and plan deficit, end of year 115 3 118 159 4 163

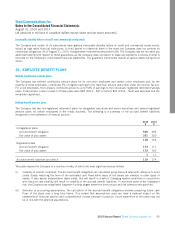

The weighted average duration of the defined benefit obligation of the SERP and ERP at August 31, 2015 is 15.3 years and

22.5 years, respectively.

94 Shaw Communications Inc. 2015 Annual Report