Shaw 2015 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2015 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

Management’s Discussion and Analysis

August 31, 2015

Other income and expenses

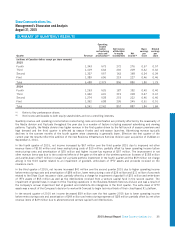

(millions of Canadian dollars) 2015 2014

Increase

(decrease)

in

income

Gain on sale of media assets –49 (49)

Business acquisition costs (6) (4) (2)

Accretion of long-term liabilities and provisions (3) (6) 3

Debt retirement costs –(8) 8

Equity loss of a joint venture (56) – (56)

Gain on sale of wireless spectrum licenses 158 – 158

Impairment of goodwill (15) – (15)

Other losses (49) (6) (43)

During 2013, the Company agreed to sell its 50% interest in its two French-language channels, Historia and Series+, to Corus,

a related party subject to common voting control. The sale of Historia and Series+ closed on January 1, 2014 and the company

recorded proceeds of $141 million and a gain of $49 million.

The Company incurred $6 million of acquisition related costs in fiscal 2015 for professional fees paid to lawyers, consultants

and advisors in respect of the acquisition of ViaWest which closed on September 2, 2014. In fiscal 2014, the Company

incurred $4 million of acquisition costs related to ViaWest.

The Company records accretion expense in respect of the discounting of certain long-term liabilities and provisions which are

accreted to their estimated value over their respective terms. The expense is primarily in respect of CRTC benefit obligations.

On February 18, 2014, the Company redeemed the $600 million 6.50% senior notes due June 2, 2014. In connection with

the early redemption, the Company incurred costs of $7 million and wrote-off the remaining finance costs of $1 million.

The Company recorded an equity loss of $56 million in fiscal 2015 related to its interest in shomi, the subscription video-on-

demand service launched in early November 2014. The equity loss includes amounts in respect of the development and launch

of the business.

During the year, Rogers Communications Inc. exercised its option to acquire the Company’s AWS spectrum as announced in

January 2013. Previously the Company received $50 million in respect of the purchase price of the option to acquire wireless

spectrum licenses and a $200 million deposit in respect of the option exercise price. The Company received an additional

$100 million when the transaction completed and recorded a gain of $158 million.

As a result of the Company’s annual impairment test of goodwill and indefinite-life intangibles, an impairment charge of $15

million was recorded in fiscal 2015 with respect to the Tracking operations in the Business Network Services division.

Other losses category generally includes realized and unrealized foreign exchange gains and losses on U.S. dollar denominated

current assets and liabilities, gains and losses on disposal of property, plant and equipment and minor investments, and the

Company’s share of the operations of Burrard Landing Lot 2 Holdings Partnership (“Partnership”). In the current year, the

category also includes a write-down of $6 million in respect of the property classified as held for sale, distributions of $27

million from a venture capital fund investment, a write-down of $27 million in respect of a private portfolio investment and

additional proceeds of $15 million related to the fiscal 2012 Shaw Court insurance claim while the comparative year includes a

refund of $5 million from the Canwest CCAA plan implementation fund and proceeds of $6 million in respect of the

aforementioned insurance claim. In addition, the current and prior year both include asset write-downs of $55 million and $6

million, respectively. The write-down in the current period relates to assets in respect to development of a certain Internet

Protocol Television (“IPTV”) platform which the Company has now abandoned.

Income tax expense

The income tax expense was calculated using current statutory income tax rates of 25.7% for 2015 and 26.0% for 2014 and

was adjusted for the reconciling items identified in Note 23 to the Consolidated Financial Statements.

40 Shaw Communications Inc. 2015 Annual Report