Shaw 2015 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2015 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Shaw Communications Inc.

Notes to the Consolidated Financial Statements

August 31, 2015 and 2014

[all amounts in millions of canadian dollars except share and per share amounts]

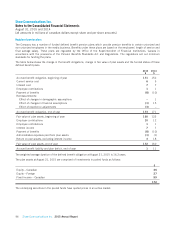

Currency risk

Certain of the Company’s capital expenditures and equipment costs in respect of its Canadian operations are incurred in US

dollars, while its revenue is primarily denominated in Canadian dollars. Decreases in the value of the Canadian dollar relative to

the US dollar could have an adverse effect on the Company’s cash flows. To mitigate some of the uncertainty in respect of

capital expenditures and equipment costs, the Company regularly enters into forward contracts in respect of US dollar

commitments. With respect to 2015, the Company entered into forward contracts to purchase US $100 over a period of 10

months commencing in November 2014 at an average exchange rate of 1.1586 Cdn. At August 31, 2015 the Company had no

forward contracts in respect of US dollar commitments.

The Company’s net investment in its foreign operation is exposed to market risk attributable to fluctuations in foreign currency

exchange rates in respect of changes in the value of the Canadian dollar versus the US dollar. This risk is partially mitigated as

a portion of the purchase price of ViaWest was borrowed in US dollars under the Company’s credit facility. At August 31, 2015,

the investment in ViaWest amounted to US $812. The exchange rate used to convert US dollars into Canadian dollars for the

statement of financial position at August 31, 2015 was $1.3157 Cdn. The impact of a 10% change in the exchange rate would

change other comprehensive income by $63.

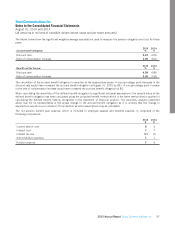

Interest rate risk

Due to the capital-intensive nature of its operations, the Company utilizes long-term financing extensively in its capital

structure. The primary components of this structure are a banking facility and various Canadian senior notes with varying

maturities issued in the public markets as more fully described in note 13.

Interest on the Company’s unsecured banking facility and ViaWest’s credit facilities are based on floating rates, while the senior

notes are primarily fixed-rate obligations. The Company utilizes its banking facility to finance day-to-day operations and,

depending on market conditions, periodically converts the bank loans to fixed-rate instruments through public market debt

issues. As at August 31, 2015, 78% of the Company’s consolidated long-term debt was fixed with respect to interest rates.

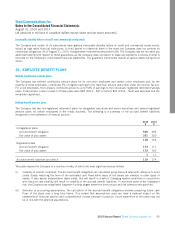

Sensitivity analysis

The Company held no foreign exchange forward contracts at August 31, 2015. A portion of the Company’s accounts receivable

and accounts payable and accrued liabilities in respect of its Canadian operations is denominated in US dollars; however, due

to their short-term nature, there is no significant market risk arising from fluctuations in foreign exchange rates.

Interest on the Company’s banking and credit facilities are based on floating rates and the variable rate senior notes are based

on CDOR. There is no significant market risk arising from interest rates fluctuating by reasonably possible amounts from their

actual values at August 31, 2015.

A change of one dollar in the market price per share of the Company’s publicly traded investment would change other

comprehensive loss by $1 at August 31, 2015.

At August 31, 2015, a one dollar change in the Company’s Class B Non-Voting Shares would not have had an impact on net

income in respect of the Company’s DSU plan.

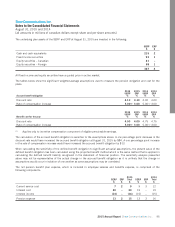

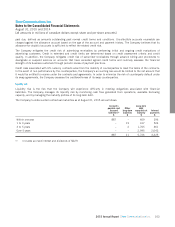

Credit risk

Accounts receivable in respect of the Consumer, Business Networks Services and Business Infrastructure Services divisions are

not subject to any significant concentrations of credit risk due to the Company’s large and diverse customer bases. For the

Media division, a significant portion of sales are made to advertising agencies which results in some concentration of credit risk.

At August 31, 2015, approximately 72% (2014 – 61%) of the $186 (2014 – $201) of advertising receivables is due from the

ten largest accounts. The largest amount due from an advertising agency is $20 (2014 – $20) which is approximately 11%

(2014 – 10%) of advertising receivables. As at August 31, 2015, the Company had accounts receivable of $468 (August 31,

2014 – $493), net of the allowance for doubtful accounts of $26 (August 31, 2014 – $32). The Company maintains an

allowance for doubtful accounts for the estimated losses resulting from the inability of its customers to make required

payments. In determining the allowance, the Company considers factors such as the number of days the customer account is

past due, whether or not the customer continues to receive service, the Company’s past collection history and changes in

business circumstances. As at August 31, 2015, $121 (August 31, 2014 – $129) of accounts receivable is considered to be

102 Shaw Communications Inc. 2015 Annual Report