Shaw 2015 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2015 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

Notes to the Consolidated Financial Statements

August 31, 2015 and 2014

[all amounts in millions of canadian dollars except share and per share amounts]

past due, defined as amounts outstanding past normal credit terms and conditions. Uncollectible accounts receivable are

charged against the allowance account based on the age of the account and payment history. The Company believes that its

allowance for doubtful accounts is sufficient to reflect the related credit risk.

The Company mitigates the credit risk of advertising receivables by performing initial and ongoing credit evaluations of

advertising customers. Credit is extended and credit limits are determined based on credit assessment criteria and credit

quality. In addition, the Company mitigates credit risk of subscriber receivables through advance billing and procedures to

downgrade or suspend services on accounts that have exceeded agreed credit terms and routinely assesses the financial

strength of its business customers through periodic review of payment practices.

Credit risks associated with US currency contracts arise from the inability of counterparties to meet the terms of the contracts.

In the event of non-performance by the counterparties, the Company’s accounting loss would be limited to the net amount that

it would be entitled to receive under the contracts and agreements. In order to minimize the risk of counterparty default under

its swap agreements, the Company assesses the creditworthiness of its swap counterparties.

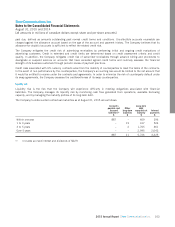

Liquidity risk

Liquidity risk is the risk that the Company will experience difficulty in meeting obligations associated with financial

liabilities. The Company manages its liquidity risk by monitoring cash flow generated from operations, available borrowing

capacity, and by managing the maturity profiles of its long-term debt.

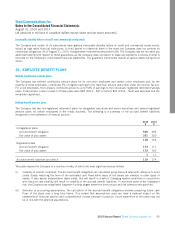

The Company’s undiscounted contractual maturities as at August 31, 2015 are as follows:

Accounts

payable and

accrued

liabilities(1)

$

Other

long-term

liabilities

$

Long-term

debt

repayable at

maturity

$

Interest

payments

$

Within one year 887 – 609 296

1 to 3 years – 19 417 526

3 to 5 years – 2 1,705 461

Over 5 years – – 2,995 2,042

887 21 5,726 3,325

(1) Includes accrued interest and dividends of $229.

2015 Annual Report Shaw Communications Inc. 103