Shaw 2015 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2015 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

Notes to the Consolidated Financial Statements

August 31, 2015 and 2014

[all amounts in millions of canadian dollars except share and per share amounts]

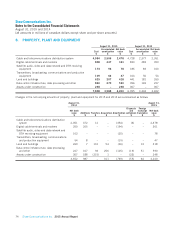

The purchase consideration consisted of $898 of cash and issuance of share-based awards of $8. A summary of net assets and

allocation of consideration is as follows:

$

Net assets acquired at assigned fair values

Cash and cash equivalents 5

Receivables 10

Other current assets 5

Property and equipment 311

Other long-term assets 2

Intangibles(1) 404

Goodwill, not deductible for tax(2) 674

1,411

Current liabilities 16

Current debt(3) 7

Deferred income taxes 76

Long-term debt(3) 406

906

(1) Intangibles include a trade name, customer relationships and software assets.

(2) Goodwill comprises the value of upside and expansion potential due to industry growth expectations and demand for data

centre services as well as a strong management team and an assembled workforce.

(3) Current and long-term debt is comprised of amounts that were outstanding under ViaWest’s credit facility, finance lease

obligations in respect of certain equipment and amounts owing to landlords in respect of financing leasehold

improvements.

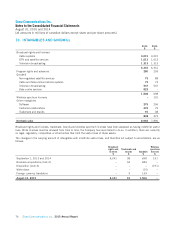

Other

Effective June 30, 2015, ViaWest acquired 100% of the shares of AppliedTrust Engineering, Inc. (“AppliedTrust”), a provider

of security, compliance, DevOps and infrastructure consulting services to a wide range of clients. AppliedTrust’s capabilities

augment the ViaWest platform with fast enablement of secure hybrid services including IT assessment, migration, compliance

consulting, cloud readiness and deeper application support. The purchase consideration consisted of $9 in cash and contingent

consideration of $2.

A summary of net assets and preliminary allocation of consideration is as follows:

$

Net assets acquired at assigned fair values

Receivables 1

Goodwill, not deductible for tax(1) 10

11

(1) Goodwill comprises the estimated economic value of providing enhanced professional services offerings, growth

expectations as well as an assembled workforce with deep expertise in risk management and compliance consulting

services.

2015 Annual Report Shaw Communications Inc. 71