Shaw 2015 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2015 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

Notes to the Consolidated Financial Statements

August 31, 2015 and 2014

[all amounts in millions of canadian dollars except share and per share amounts]

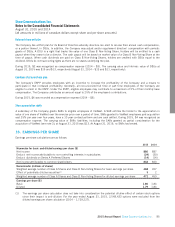

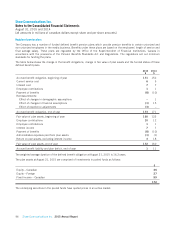

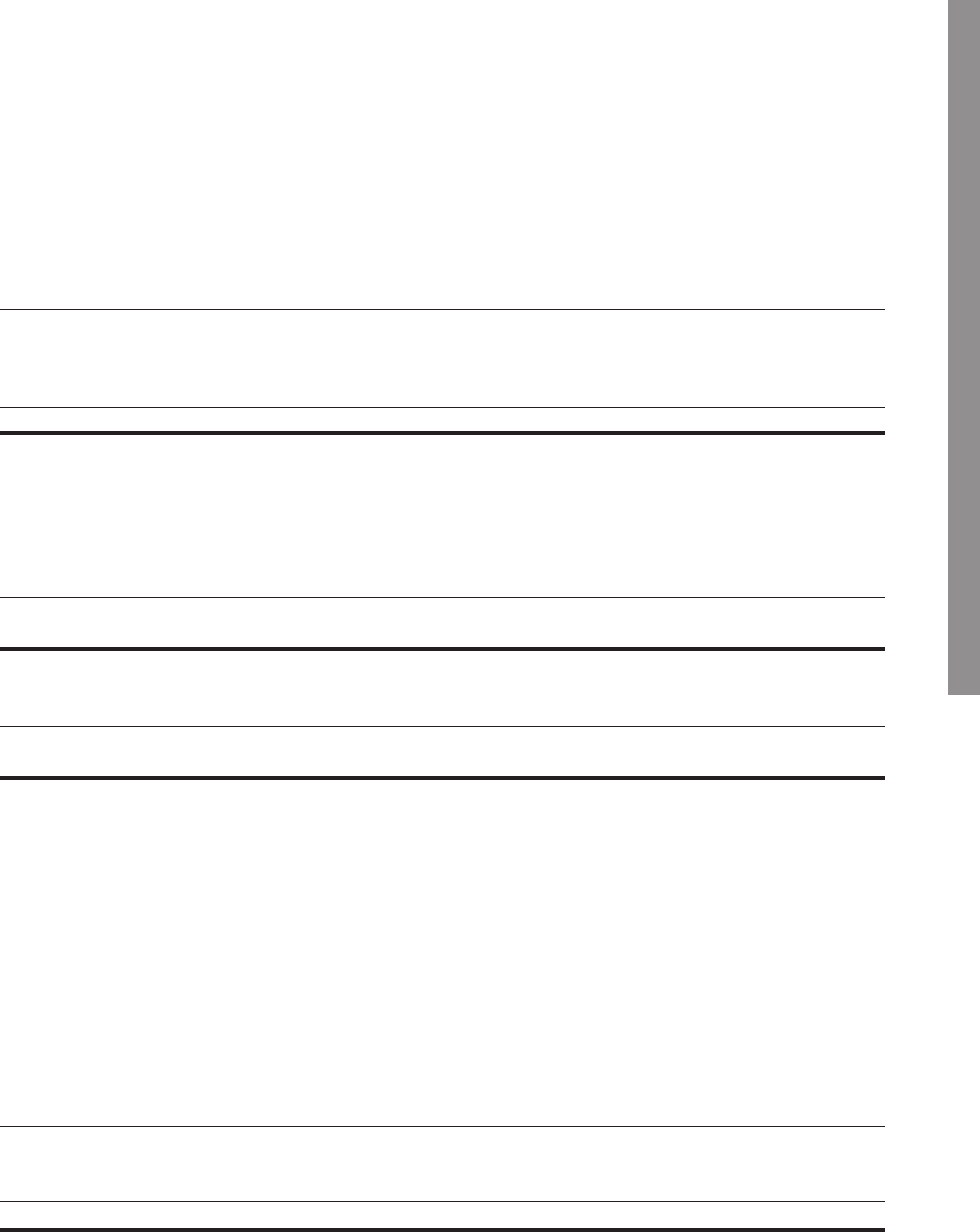

The underlying plan assets of the SERP and ERP at August 31, 2015 are invested in the following:

SERP

$

ERP

$

Cash and cash equivalents 215 2

Fixed income securities 93 1

Equity securities – Canadian 21 –

Equity securities – Foreign 58 1

387 4

All fixed income and equity securities have a quoted price in active market.

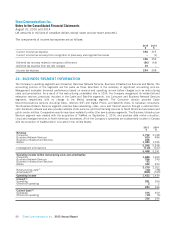

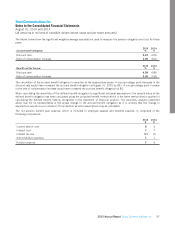

The tables below show the significant weighted-average assumptions used to measure the pension obligation and cost for the

plans.

Accrued benefit obligation

2015

SERP

%

2015

ERP

%

2014

SERP

%

2014

ERP

%

Discount rate 4.10 4.10 4.00 4.00

Rate of compensation increase 5.00(1) 3.00 5.00(1) 3.00

Benefit cost for the year

2015

SERP

%

2015

ERP

%

2014

SERP

%

2014

ERP

%

Discount rate 4.00 4.00 4.75 4.75

Rate of compensation increase 5.00(1) 3.00 5.00(1) 3.00

(1) Applies only to incentive compensation component of eligible pensionable earnings.

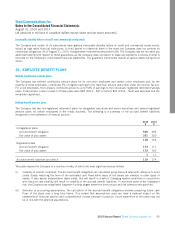

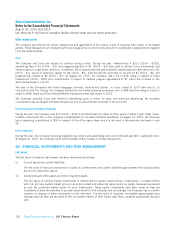

The calculation of the accrued benefit obligation is sensitive to the assumptions above. A one percentage point decrease in the

discount rate would have increased the accrued benefit obligation at August 31, 2015 by $84. A one percentage point increase

in the rate of compensation increase would have increased the accrued benefit obligation by $13.

When calculating the sensitivity of the defined benefit obligation to significant actuarial assumptions, the present value of the

defined benefit obligation has been calculated using the projected benefit method which is the same method that is applied in

calculating the defined benefit liability recognized in the statement of financial position. The sensitivity analysis presented

above may not be representative of the actual change in the accrued benefit obligation as it is unlikely that the change in

assumptions would occur in isolation of one another as some assumptions may be correlated.

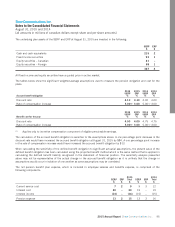

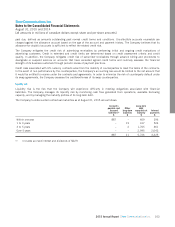

The net pension benefit plan expense, which is included in employee salaries and benefits expense, is comprised of the

following components:

SERP

$

ERP

$

2015

Total

$

SERP

$

ERP

$

2014

Total

$

Current service cost 72 9 93 12

Interest cost 20 – 20 19 – 19

Interest income (14) – (14) (15) – (15)

Pension expense 13 2 15 13 3 16

2015 Annual Report Shaw Communications Inc. 95