Shaw 2015 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2015 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

Management’s Discussion and Analysis

August 31, 2015

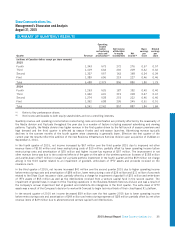

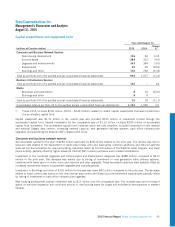

Capital expenditures and equipment costs

Year ended August 31,

(millions of Canadian dollars) 2015 2014

Change

%

Consumer and Business Network Services

New housing development 106 94 12.8

Success based 284 312 (9.0)

Upgrades and enhancements 353 364 (3.0)

Replacement 35 49 (28.6)

Buildings and other 176 258 (31.8)

Total as per Note 24 to the audited annual consolidated financial statements 954 1,077 (11.4)

Business Infrastructure Services

Total as per Note 24 to the audited annual consolidated financial statements 152 – n/a

Media

Broadcast and transmission 810 (20.0)

Buildings and other 88–

Total as per Note 24 to the audited annual consolidated financial statements 16 18 (11.1)

Consolidated total as per Note 24 to the audited annual consolidated financial statements(1) 1,122 1,095 2.5

(1) Fiscal 2015 includes $150 million (2014 – $240 million) related to certain capital investments that were funded from

the accelerated capital fund.

Capital investment was $1.12 billion in the current year and included $150 million of investment funded through the

accelerated capital fund. Capital investment for the comparable year of $1.10 billion included $240 million of accelerated

capital fund investment. The accelerated capital fund initiatives which are now complete, included investment in new internal

and external Calgary data centres, increasing network capacity, next generation delivery systems, back office infrastructure

upgrades, and expediting the Shaw Go WiFi infrastructure build.

Consumer and business network services

Success-based capital for the year of $284 million was lower by $28 million relative to the prior year. The decline was due to

reduced costs related to the deployment of cable video rental units and lower gross customer additions, and reduced satellite

video set top box activations for new and existing customers driven by the termination of the Satellite rental program, and lower

phone activity, partially offset by higher advanced Internet WiFi modem purchases and increased installations.

Investment in the combined Upgrades and Enhancement and Replacement categories was $388 million compared to $413

million in the prior year. The decrease was mainly due to timing of investment in next generation video delivery systems,

combined with lower spend in video, voice and mainline and drop upgrades. These favourable variances were partially offset by

increased investments related to bandwidth upgrades and business growth.

Investment in Buildings and other of $176 million for the year was down $82 million compared to the prior year. The decrease

relates to lower current year spend on the new internal data centre and Shaw Court refurbishment expenditures partially offset

by timing of investment on back office infrastructure upgrades.

New housing development capital investment was up $12 million over the comparable year. The increase was due to timing of

spend on mainline expansion and continued activity in new housing starts for single and multifamily developments in western

Canada.

2015 Annual Report Shaw Communications Inc. 45