Shaw 2015 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2015 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

Notes to the Consolidated Financial Statements

August 31, 2015 and 2014

[all amounts in millions of canadian dollars except share and per share amounts]

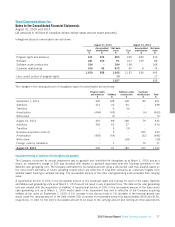

Asset dispositions

Sale of wireless spectrum licenses to Rogers Communications Inc. (“Rogers”)

During 2013, the Company granted Rogers an option to acquire its wireless spectrum licenses. The exercise of the option and

the sale of the wireless spectrum licenses were subject to various regulatory approvals and therefore, the licenses were not

classified as assets held for sale. The regulatory reviews concluded during 2015 at which time the transfer was completed. The

Company had previously received $50 in respect of the purchase price of the option to acquire the wireless spectrum licenses

and a $200 deposit in respect of the option exercise price. The Company received an additional $100 when the transaction

completed and recorded a gain of $158.

Sale of Historia and Series+ to Corus Entertainment Inc. (“Corus”)

The sale of Historia and Series+ to Corus closed in 2014. Historia and Series+ represented a disposal group within the media

segment and accordingly, were not presented as discontinued operations in the statement of income. The Company received

sale proceeds of $141 and recorded a gain of $49.

Asset held for sale

A real estate property has been classified as held for sale in the statement of financial position at August 31, 2015 and 2014

and measured at estimated fair value less costs to sell. At August 31, 2015, the property’s fair value was based on the sale

which closed subsequent to year end. Previously the estimated fair value had been determined by a commercial real estate

service by means of an income capitalization approach.

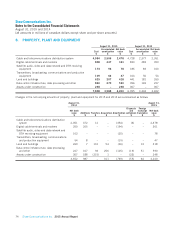

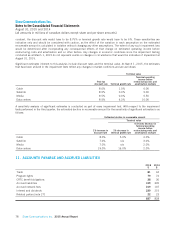

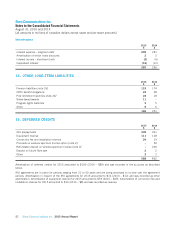

4. ACCOUNTS RECEIVABLE

2015

$

2014

$

Subscriber and trade receivables 473 506

Due from related parties [note 27] 4–

Miscellaneous receivables 17 19

494 525

Less allowance for doubtful accounts (26) (32)

468 493

Included in operating, general and administrative expenses is a provision for doubtful accounts of $29 (2014 – $38).

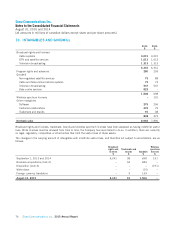

5. INVENTORIES

2015 2014

$$

Subscriber equipment 54 114

Other 65

60 119

Subscriber equipment includes DTH equipment, DCTs and related customer premise equipment.

72 Shaw Communications Inc. 2015 Annual Report