Shaw 2015 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2015 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

Management’s Discussion and Analysis

August 31, 2015

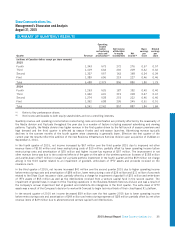

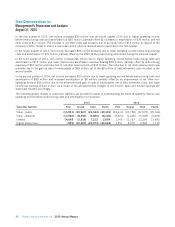

SUMMARY OF QUARTERLY RESULTS

Quarter Revenue

Operating

income

before

restructuring

costs and

amortization(1)

Net income

attributable

to equity

shareholders

Net

income(2)

Basic

earnings

per

share

Diluted

earnings

per

share

(millions of Canadian dollars except per share amounts)

2015

Fourth 1,343 573 272 276 0.57 0.57

Third 1,419 643 202 209 0.42 0.42

Second 1,337 557 163 168 0.34 0.34

First 1,389 606 219 227 0.46 0.46

Total 5,488 2,379 856 880 1.80 1.79

2014

Fourth 1,263 525 187 192 0.40 0.40

Third 1,342 601 219 228 0.47 0.47

Second 1,274 528 215 222 0.46 0.46

First 1,362 608 236 245 0.51 0.51

Total 5,241 2,262 857 887 1.84 1.84

(1) Refer to Key performance drivers.

(2) Net income attributable to both equity shareholders and non-controlling interests.

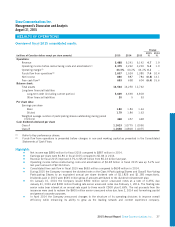

Quarterly revenue and operating income before restructuring costs and amortization are primarily affected by the seasonality of

the Media division and fluctuate throughout the year due to a number of factors including seasonal advertising and viewing

patterns. Typically, the Media division has higher revenue in the first quarter driven by the fall launch of season premieres and

high demand and the third quarter is affected by season finales and mid-season launches. Advertising revenue typically

declines in the summer months of the fourth quarter when viewership is generally lower. Effective the first quarter of the

current year the results reflect the addition of the new Business Infrastructure Services division upon acquisition of ViaWest on

September 2, 2014.

In the fourth quarter of 2015, net income increased by $67 million over the third quarter 2015 due to improved net other

revenue items of $190 million and lower restructuring costs of $10 million, partially offset by lower operating income before

restructuring costs and amortization of $70 million and higher income tax expense of $57 million. The improvement in net

other revenue items was due to the combined effects of the gain on the sale of the wireless spectrum licenses of $158 million

and a write-down of $27 million in respect of a private portfolio investment in the fourth quarter and the $59 million net charge

arising in the third quarter related to an impairment of goodwill, write-down of IPTV assets and proceeds received on the

insurance claim.

In the third quarter of 2015, net income increased $41 million over the second quarter 2015 due to higher operating income

before restructuring costs and amortization of $86 million, lower restructuring costs of $26 million and $11 million of proceeds

related to the Shaw Court insurance claim, partially offset by a charge for impairment of goodwill of $15 million and write-down

of IPTV assets of $55 million as well as the distributions received from a venture capital fund in the second quarter. The

impairment of goodwill was in respect of the Tracking operations in the Business Network Services division and was a result of

the Company’s annual impairment test of goodwill and indefinite-life intangibles in the third quarter. The write-down of IPTV

assets was a result of the Company’s decision to work with Comcast to begin technical trials of their cloud-based X1 platform.

In the second quarter of 2015 net income decreased $59 million over the first quarter 2015 due to lower operating income

before restructuring costs and amortization of $49 million and restructuring expenses of $38 million partially offset by net other

revenue items of $29 million due to aforementioned venture capital fund distributions.

2015 Annual Report Shaw Communications Inc. 35