Shaw 2015 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2015 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

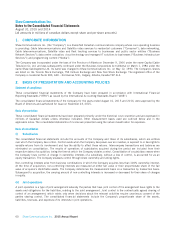

Shaw Communications Inc.

Notes to the Consolidated Financial Statements

August 31, 2015 and 2014

[all amounts in millions of canadian dollars except share and per share amounts]

Fair value measurements

Fair value estimates are made at a specific point in time, based on relevant market information and information about the

financial instrument. These estimates are subjective in nature and involve uncertainties and matters of significant judgement

and, therefore, cannot be determined with precision. Changes in assumptions could significantly affect the estimates.

The fair value hierarchy is based on inputs to valuation techniques that are used to measure fair value that are either observable

or unobservable. Observable inputs reflect assumptions market participants would use in pricing an asset or liability based on

market data obtained from independent sources while unobservable inputs reflect a reporting entity’s pricing based upon their

own market assumptions.

The fair value hierarchy consists of the following three levels:

Level 1 Inputs are quoted prices in active markets for identical assets or liabilities.

Level 2 Inputs for the asset or liability are based on observable market data, either directly or indirectly, other than quoted

prices.

Level 3 Inputs for the asset or liability are not based on observable market data.

The Company determines whether transfers have occurred between levels in the fair value hierarchy by assessing the impact of

events and changes in circumstances that could result in a transfer at the end of each reporting period.

Employee benefits

The Company accrues its obligations under its employee benefit plans, net of plan assets. The cost of pensions and other

retirement benefits earned by certain employees is actuarially determined using the projected benefit method pro-rated on

service and management’s best estimate of salary escalation and retirement ages of employees. Past service costs from plan

initiation and amendments are recognized immediately in the income statement. Remeasurements include actuarial gains or

losses and the return on plan assets (excluding interest income). Actuarial gains and losses occur because assumptions about

benefit plans relate to a long time frame and differ from actual experiences. These assumptions are revised based on actual

experience of the plans such as changes in discount rates, expected retirement ages and projected salary increases.

Remeasurements are recognized in other comprehensive income (loss) on an annual basis, at a minimum, and on an interim

basis when there are significant changes in assumptions.

August 31 is the measurement date for the Company’s employee benefit plans. The last actuarial valuations for funding

purposes for the various plans were performed effective December 31, 2014 and the next actuarial valuations for funding

purposes are effective December 31, 2015.

Share-based compensation

The Company has a stock option plan for directors, officers, employees and consultants to the Company. The options to

purchase shares must be issued at not less than the fair value at the date of grant. Any consideration paid on the exercise of

stock options, together with any contributed surplus recorded at the date the options vested, is credited to share capital. The

Company calculates the fair value of share-based compensation awarded to employees using the Black-Scholes option pricing

model. The fair value of options are expensed and credited to contributed surplus over the vesting period of the options using

the graded vesting method.

The Company has a deferred share unit (“DSU”) plan for its Board of Directors. Compensation cost is recognized immediately

as DSUs vest when granted. DSUs will be settled in cash and the obligation is measured at the end of each period at fair value

using the Black-Scholes option pricing model and the number of outstanding DSUs.

Share appreciation rights (“SARs”) issued by a subsidiary to eligible employees are cash settled and measured at fair value

using the Black-Scholes option pricing model. The fair value is recognized over the vesting period of the SARs by applying the

graded vesting method, adjusting for estimated forfeitures. The obligation for SARs is remeasured at the end of each period up

to the date of settlement which requires a reassessment of the estimates used at the end of each reporting period.

2015 Annual Report Shaw Communications Inc. 67