Shaw 2015 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2015 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

Notes to the Consolidated Financial Statements

August 31, 2015 and 2014

[all amounts in millions of canadian dollars except share and per share amounts]

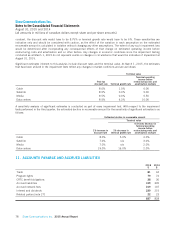

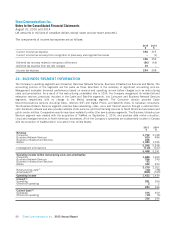

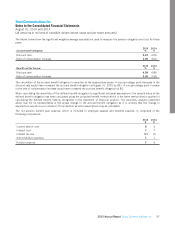

21. OPERATING, GENERAL AND ADMINISTRATIVE EXPENSES

AND RESTRUCTURING COSTS

2015

$

2014

$

Employee salaries and benefits 987 945

Purchases of goods and services 2,174 2,092

3,161 3,037

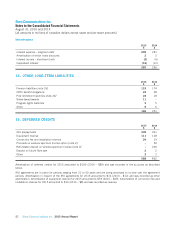

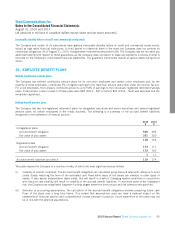

22. OTHER LOSSES

Other losses generally includes realized and unrealized foreign exchange gains and losses on US dollar denominated current

assets and liabilities, gains and losses on disposal of property, plant and equipment and minor investments, and the Company’s

share of the operations of Burrard Landing Lot 2 Holdings Partnership. In the current year, the category also includes a write-

down of $6 in respect of the property classified as held for sale, distributions of $27 from a venture capital fund investment, a

write-down of $27 in respect of a private portfolio investment and additional proceeds of $15 related to the fiscal 2012 Shaw

Court insurance claim while the comparative year includes a refund of $5 from the Canwest CCAA plan implementation fund

and proceeds of $6 in respect of the aforementioned insurance claim. In addition, the current and prior year both include asset

write-downs of $55 and $6, respectively. The write-down of assets in the current year related to assets in respect to

development of a certain IPTV platform which the Company has now abandoned.

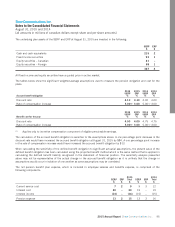

23. INCOME TAXES

Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities

for financial reporting purposes and the amounts used for income tax purposes. The Company’s net deferred tax liability

consists of the following:

2015

$

2014

$

Deferred tax assets 14 26

Deferred tax liabilities (1,135) (1,105)

Net deferred tax liability (1,121) (1,079)

88 Shaw Communications Inc. 2015 Annual Report