Shaw 2015 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2015 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

Management’s Discussion and Analysis

August 31, 2015

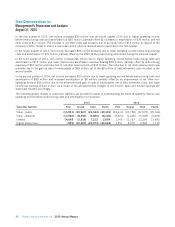

RELATED PARTY TRANSACTIONS

Related party transactions are reviewed by Shaw’s Corporate Governance and Nominating Committee, comprised of independent

directors. The following sets forth certain transactions in which the Company is involved.

Corus

The Company and Corus are subject to common voting control. During the year, network, advertising and programming fees

were paid to various Corus subsidiaries. The Company provided uplink of television signals, programming content, Internet

services and lease of circuits to various Corus subsidiaries. In addition, the Company provided Corus with television advertising

spots in return for radio and television advertising.

During 2014, the Company closed the sale of its 50% interest in two French-language channels, Historia and Series+, to Corus.

Burrard Landing Lot 2 Holdings Partnership

The Company has a 33.33% interest in the Partnership. During the current year, the Company paid the Partnership for lease of

office space in Shaw Tower. Shaw Tower, located in Vancouver, BC, is the Company’s headquarters for its lower mainland

operations.

Key management personnel and board of directors

Key management personnel consist of the most senior executive team and along with the Board of Directors have the authority

and responsibility for directing and controlling the activities of the Company. In addition to compensation provided to key

management personnel and the Board of Directors for services rendered, the Company transacts with companies related to

certain Board members primarily for the purchase of remote control units, network programming and installation of equipment.

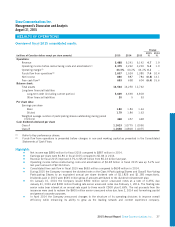

NEW ACCOUNTING STANDARDS

Shaw has adopted or will adopt a number of new accounting policies as a result of recent changes in IFRS as issued by the

IASB. The ensuing discussion provides additional information as to the date that Shaw is or was required to adopt the new

standards, the methods of adoption permitted by the standards, the method chosen by Shaw, and the effect on the financial

statements as a result of adopting the new policies. The adoption or future adoption of these accounting policies has not and is

not expected to result in changes to the Company’s current business practices.

Adoption of recent accounting pronouncement

The adoption of the following standard effective September 1, 2014 had no impact on the Company’s consolidated financial

statements.

ŠIFRIC 21 Levies, provides guidance on when to recognize a financial liability imposed by a government, if the levy is

accounted for in accordance with IAS 37, Provisions, Contingent Liabilities and Contingent Assets, or where the timing

and amount of the levy is certain.

Standards, interpretations and amendments to standards issued but not yet effective

The Company has not yet adopted certain standards, interpretations and amendments that have been issued but are not yet

effective. The following pronouncements are being assessed to determine their impact on the Company’s results and financial

position.

ŠClarification of Acceptable Methods of Depreciation and Amortization (Amendments to IAS 16 Property, Plant and

Equipment and IAS 38 Intangible Assets) prohibits revenue from being used as a basis to depreciate property, plant and

equipment and significantly limits use of revenue-based amortization for intangible assets. The amendments are to be

applied prospectively for the annual period commencing September 1, 2016.

ŠIFRS 15 Revenue from Contracts with Customers, was issued in May 2014 and replaces IAS 11 Construction Contracts,

IAS 18 Revenue, IFRIC 13 Customer Loyalty Programs, IFRIC 15 Agreements for the Construction of Real Estate, IFRIC

18 Transfers of Assets from Customers and SIC-31 Revenue—Barter Transactions Involving Advertising Services. The

new standard requires revenue to be recognized to depict the transfer of promised goods or services to customers in an

amount that reflects the consideration expected to be received in exchange for those goods or services. The principles are

2015 Annual Report Shaw Communications Inc. 29