Shaw 2015 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2015 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Shaw Communications Inc.

Management’s Discussion and Analysis

August 31, 2015

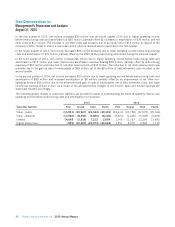

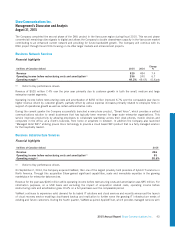

Commencing in fiscal 2015, Shaw’s residential and enterprise services are reorganized into new Consumer and

Business units, respectively, with no changes to the Media division.

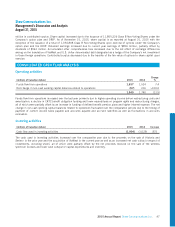

ŠThe Company recorded restructuring costs of $58 million in fiscal 2014 associated with the approximately

400 management and non-customer facing roles which were eliminated by organizational changes in that

year.

ŠIn 2015, the Company recorded $52 million in respect of continued restructuring, primarily related to severance

and employee related costs, which impacted approximately 1,700 employees.

ŠThe Company announced a realignment of its customer care operations into centres of expertise in order to

improve the end-to-end customer service experience. The realignment affected approximately 1,600

employees.

ŠThe Company also continued its organizational structure realignment efforts, including further restructuring

of certain functions within Business Network Services.

ŠThe Media division undertook organizational changes as it redefines itself from a traditional broadcaster to

the broader focus of a media organization. Approximately 100 roles were eliminated and 45 new roles

created.

ŠAs a result of these restructurings, the Company expects to realize aggregate annual cost savings, net of new

hires to support the restructured operations, of approximately $75 million. These efficiencies will phase in

through fiscal 2016 and be fully realized in fiscal 2017.

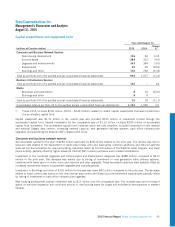

ŠDuring fiscal 2015 and 2014, the Company entered into a number of transactions as follows:

ŠIn late fiscal 2014, the Company announced it had entered into agreements to acquire 100% of the shares

of ViaWest for an enterprise value of US$1.2 billion. ViaWest is headquartered in Denver, Colorado and has

27 data centres in 8 key Western U.S. markets providing collocation, cloud and managed services. On

September 2, 2014, the Company closed the acquisition which was funded through a combination of cash

on hand, assumption of ViaWest debt and a drawdown of US$330 million on the Company’s credit facility.

The ViaWest acquisition provides the Company with a growth platform in the North American data centre

sector and is another step in expanding technology offerings for mid-market enterprises in Western Canada.

ŠDuring the current year, the Company partnered with Rogers to form shomi, a new subscription video-on-

demand service having the latest most exclusive shows and selections personalized for viewers. The service

was launched in beta in early November 2014 and was made available to all Canadians in August 2015.

ŠDuring 2013, the Company granted Rogers Communications Inc. (“Rogers”) an option to acquire its wireless

spectrum licenses. The exercise of the option and the sale of the wireless spectrum licenses were subject to

various regulatory approvals and therefore, the licenses were not classified as held for sale. During the fiscal

2015, the regulatory reviews concluded at which time Rogers exercised its option and the transfer was

completed. The Company had previously received $50 in respect of the purchase price of the option to

acquire wireless spectrum licenses and a $200 deposit in respect of the option exercise price. The Company

received an additional $100 when the transaction completed and recorded a gain of $158.

ŠDuring 2014, the Company completed sale of its 50% interest in its two French-language channels, Historia

and Series+, to Corus.

ŠDuring 2013, the Company established a notional fund, the accelerated capital fund, of up to $500 million with

proceeds received, and to be received, from the strategic transactions with each of Rogers and Corus. Accelerated

capital initiatives are being funded through this fund and not cash generated from operations. Key investments

include the Calgary data centres, further digitization of the network and additional bandwidth upgrades,

development of IP delivery of video, expansion of the WiFi network, and additional innovative product offerings

related to Shaw Go and other applications to provide an enhanced customer experience. Approximately $110

million was invested in fiscal 2013, $240 million in fiscal 2014, and $150 million in fiscal 2015.

ŠThe Company continued to expand on its TV Everywhere content strategy launching Global Go and a number of

Shaw Go apps during fiscal 2014, giving subscribers on-the-go access to their favorite programming.

ŠShaw also continued to invest in and build awareness of Shaw Go WiFi and as at August 31, 2015 had almost

75,000 access points and 2 million devices authenticated on the network, reflecting the value of the service to

customers.

38 Shaw Communications Inc. 2015 Annual Report