Shaw 2015 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2015 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

Notes to the Consolidated Financial Statements

August 31, 2015 and 2014

[all amounts in millions of canadian dollars except share and per share amounts]

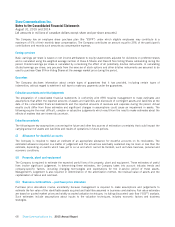

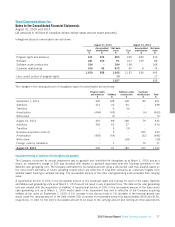

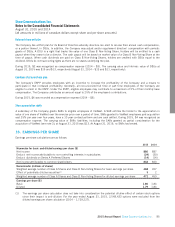

constant, the discount rate would have to be 8.75% or terminal growth rate would have to be 6%. These sensitivities are

indicative only and should be considered with caution, as the effect of the variation in each assumption on the estimated

recoverable amount is calculated in isolation without changing any other assumptions. The extent of any such impairment loss

would be determined after incorporating any consequential effects of that change on estimated operating income before

restructuring costs and amortization and on other factors. Any changes in economic conditions since the impairment testing

conducted as at March 1, 2015 do not represent events or changes in circumstance that would be indicative of impairment at

August 31, 2015.

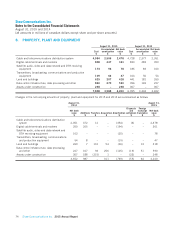

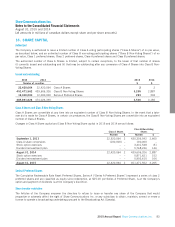

Significant estimates inherent to this analysis include discount rates and the terminal value. At March 1, 2015, the estimates

that have been utilized in the impairment tests reflect any changes in market conditions and are as follows:

Terminal value

Post-tax

discount rate Terminal growth rate

Terminal operating

income before

restructuring costs and

amortization multiple

Cable 8.0% 1.0% 6.0X

Satellite 8.5% 0.0% 5.0X

Media 8.5% 0.0% 6.5X

Data centres 8.5% 6.3% 10.0X

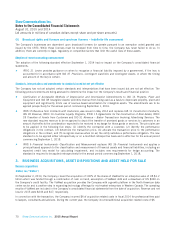

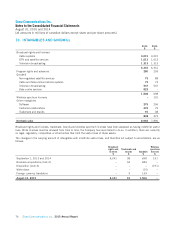

A sensitivity analysis of significant estimates is conducted as part of every impairment test. With respect to the impairment

tests performed in the third quarter, the estimated decline in recoverable amount for the sensitivity of significant estimates is as

follows:

Estimated decline in recoverable amount

Terminal value

1% increase in

discount rate

1% decrease in

terminal growth rate

0.5 times decrease in

terminal operating

income before

restructuring costs and

amortization multiple

Cable 8.0% 5.0% 3.0%

Satellite 7.0% n/a 3.0%

Media 7.0% n/a 2.0%

Data centres 19.0% 16.0% 2.0%

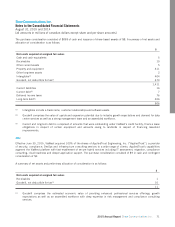

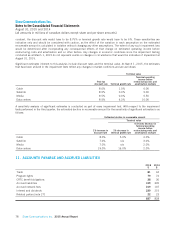

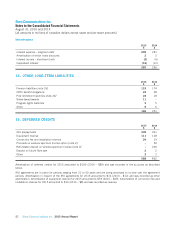

11. ACCOUNTS PAYABLE AND ACCRUED LIABILITIES

2015 2014

$$

Trade 81 44

Program rights 79 74

CRTC benefit obligations 28 30

Accrued liabilities 339 335

Accrued network fees 109 107

Interest and dividends 229 215

Related parties [note 27] 22 23

887 828

78 Shaw Communications Inc. 2015 Annual Report