Shaw 2015 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2015 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

Notes to the Consolidated Financial Statements

August 31, 2015 and 2014

[all amounts in millions of canadian dollars except share and per share amounts]

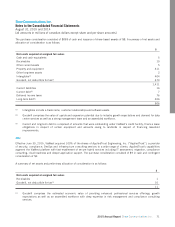

Other

ViaWest

During 2015, ViaWest’s credit facility which was assumed on acquisition was repaid with proceeds from a new credit facility.

ViaWest’s prior credit facility was scheduled to mature in May 2017 and was secured by a first priority security interest in

specific assets pursuant to the terms of the Security Agreement. On September 2, 2014, ViaWest’s credit facility consisted of a

term loan of US $322 and US $28 of borrowings under a US $40 revolving facility. The term loan had quarterly principal

repayments of US $1 with the balance due on maturity. Interest rates fluctuated with LIBOR, US prime, US Federal Funds and

Eurodollar rates. ViaWest had a US $130 interest rate swap which hedged the exposure to changes in cash flows and minimized

variability related to its prior credit facility. The interest rate swap terminated in June 2015. The new facility consists of a term

loan in the amount of US $395 and a revolving credit facility of US $85. Commencing August 2015, the term loan has

quarterly principal repayments of US $1 with the balance due on maturity in March 2022 while the revolving credit facility

matures in March 2020. Interest rates fluctuate with LIBOR, US prime and US Federal Funds rates and the facilities are

secured by a first priority security interest in specific assets pursuant to the terms of the Security Agreement.

Finance lease obligations and amounts owing to landlords in connection with financing of leasehold improvements expire and

mature at various dates through to 2023. Collateral has been provided as security for the related transactions and agreements

as required. The effective interest rates on the obligations range from 4.42% to 9.39%.

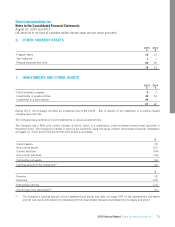

Burrard Landing Lot 2 Holdings Partnership (the “Partnership”)

The Company has a 33.33% interest in the Partnership which built the Shaw Tower project with office/retail space and living/

working space in Vancouver, BC. In the fall of 2004, the commercial construction of the building was completed and at that

time, the Partnership issued ten year 6.31% secured mortgage bonds in respect of the commercial component of the Shaw

Tower. In February 2014, the Partnership refinanced its debt. The Partnership received a mortgage loan and used the proceeds

to prepay the outstanding balance of the previous mortgage and loan excess funds to each of its partners. The mortgage loan

matures on November 1, 2024 and bears interest at 4.683% compounded semi-annually with interest only payable for the first

five years. The mortgage loan is collateralized by the property and the commercial rental income from the building with no

recourse to the Company.

Debt retirement costs

On February 18, 2014, the Company redeemed the 6.50% senior notes. In connection with the early redemption, the Company

incurred costs of $7 and wrote-off the remaining finance costs of $1.

Debt covenants

The Company and its subsidiaries have undertaken to maintain certain covenants in respect of the credit agreements and trust

indentures described above. The Company and its subsidiaries were in compliance with these covenants at August 31, 2015.

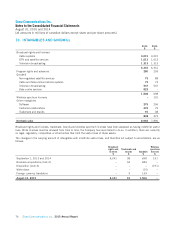

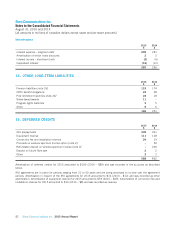

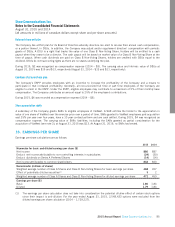

Long-term debt repayments

Mandatory principal repayments on all long-term debt in each of the next five years and thereafter are as follows:

$

2016 609

2017 408

2018 9

2019 10

2020 1,695

Thereafter 2,995

5,726

2015 Annual Report Shaw Communications Inc. 81