Shaw 2015 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2015 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

Notes to the Consolidated Financial Statements

August 31, 2015 and 2014

[all amounts in millions of canadian dollars except share and per share amounts]

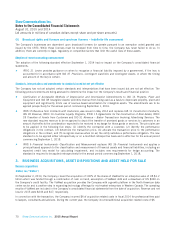

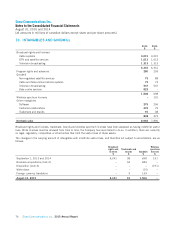

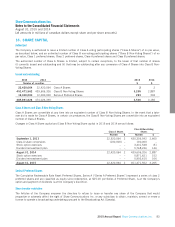

13. LONG-TERM DEBT

2015 2014

Effective

interest

rates

%

Long-term

debt at

amortized

cost(1)

$

Adjustment

for

finance

costs(1)

$

Long-term

debt

repayable at

maturity

$

Long-term

debt at

amortized

cost(1)

$

Adjustment

for

finance

costs(1)

$

Long-term

debt

repayable at

maturity

$

Corporate

Bank loans Variable 434 – 434 –– –

Cdn fixed rate senior notes-

6.15% due May 9, 2016 6.34 299 1 300 298 2 300

5.70% due March 2, 2017 5.72 399 1 400 398 2 400

5.65% due October 1, 2019 5.69 1,245 5 1,250 1,244 6 1,250

5.50% due December 7, 2020 5.55 497 3 500 497 3 500

4.35% due January 31, 2024 4.35 497 3 500 497 3 500

6.75% due November 9, 2039 6.89 1,418 32 1,450 1,417 33 1,450

4,789 45 4,834 4,351 49 4,400

Cdn variable rate senior notes-

Due February 1, 2016 300 – 300 299 1 300

5,089 45 5,134 4,650 50 4,700

Other

ViaWest – credit facility Variable 506 12 518 –– –

ViaWest – other Various 34 – 34 –– –

Burrard Landing Lot 2 Holdings Partnership 4.68 40 – 40 40 – 40

Total consolidated debt 5,669 57 5,726 4,690 50 4,740

Less current portion 608 1 609 –– –

5,061 56 5,117 4,690 50 4,740

(1) Long-term debt is presented net of unamortized discounts and finance costs.

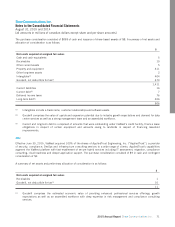

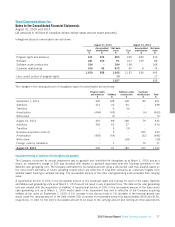

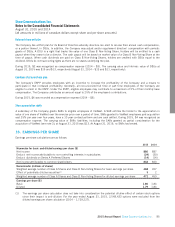

Corporate

Bank loans

During 2012, a syndicate of banks provided the Company with an unsecured $1 billion credit facility which includes a

maximum revolving term or swingline facility of $50. During 2014, the Company amended the terms of the facility to extend

the maturity date from January 2017 to December 2019. The credit facility has a feature whereby the Company may request an

additional $500 of borrowing capacity so long as no event of default or pending event of default has occurred and is continuing

or would occur as a result of the increased borrowings. No lender has any obligation to participate in the requested increase

unless it agrees to do so at its sole discretion. Funds are available to the Company in both Canadian and US dollars. At

August 31, 2015, $1 has been drawn as committed letters of credit against the revolving term facility. Interest rates fluctuate

with Canadian prime and bankers’ acceptance rates, US bank base rates and LIBOR rates. Excluding the revolving term facility,

the effective interest rate on actual borrowings under the credit facility during 2015 was 1.57%. No amounts were drawn under

the under the credit facility during 2014. The effective interest rate on the revolving term facility for 2015 was 3.24% (2014 –

3.38%).

Senior notes

The senior notes are unsecured obligations and rank equally and ratably with all existing and future senior indebtedness. The

fixed rate notes are redeemable at the Company’s option at any time, in whole or in part, prior to maturity at 100% of the

principal amount plus a make-whole premium.

On January 31, 2014, the Company issued $500 senior notes at a rate of 4.35% due January 31, 2024 and $300 floating rate

senior rates due February 1, 2016. The $300 senior notes bear interest at an annual rate equal to three month CDOR plus

0.69%.

80 Shaw Communications Inc. 2015 Annual Report